Does the tax office have the right to withdraw money from the card? Does the tax service have the right to withdraw money from the card for a fine?

As you know, all operations must be carried out transparently and not infringe on the rights of users.

- Having written a complaint about the work of the bank, you should prepare an application for the actions of the bailiffs (if the person has not received a copy of the writ of execution or other notice from the FSSP employees). You will have to put in a lot of effort, but with the right approach you can achieve a full return of the written-off funds. The duties of bailiffs include monitoring and initiating enforcement proceedings. The tax office withdrew money from the card. You can use any remote services that allow you to quickly find out whether you have fines. If so, for what, terms and amounts of payment. This will allow you to avoid proceedings by bailiffs and debiting funds from your card account. In addition, you will have time to appeal the decisions in court.

Withdrawing money from a card for debts

The bailiff can begin to write off the debtor's funds in the bank only if the following documents are available:

- court order and decision,

- writ of execution,

- decisions to collect a fine or other costs.

The lack of documentation leads to the fact that the FSSP employee is deprived of the right to withdraw the debtor’s funds located in the bank. Video How is capital withdrawn from a debtor’s bank card? Today there is a standard procedure for forced collection of funds.

When enforcement proceedings are initiated, the debtor will receive appropriate notification. Collection of funds from the card by bailiffs cannot be carried out without warning.

Having received the notice, the debtor is obliged to repay the debt. If this does not happen within 5 days, no fine will be imposed, but the funds will be forcibly withdrawn.

Does the tax service have the right to withdraw money from the card for a fine?

After sending a message about the completion of enforcement proceedings, subsequent debiting of funds from a bank card or account is considered illegal. Video Are banks required to transmit information about the debtor's account? When debiting funds from a client’s card or account, credit institutions are guided by the principle that each person must be responsible for their actions.

When borrowing funds, a person must understand that if enforcement proceedings begin, the loan money may also be written off. Bailiffs work closely with tax authorities and interact with banks.

Do bailiffs have the right to withdraw money from a bank card?

Does the tax service have the right to withdraw money from the card for fines? Please tell me whether the actions of the bailiff are legal and how to find out why the money was withdrawn? Collapse Victoria Dymova Support employee Pravoved.ru Try looking here:

- How to challenge fines and taxes for a car that was sold three years ago?

- I sold my car 2 years ago without supporting documents, there are fines and taxes

You can get an answer faster if you call the toll-free hotline for Moscow and the Moscow region: 8 499 705-84-25 Free lawyers on the line: 9 Answers from lawyers (1)

- All legal services in Moscow Drawing up an application for debt collection on a receipt Moscow from 25,000 rubles. Assistance in collecting debts of the testator from heirs Moscow from 30,000 rubles.

Can bailiffs withdraw money from a bank card?

Specialists responsible for the execution of a court decision have the right to request:

- information about the availability of current accounts with the debtor,

- information about the amount of money of an unscrupulous citizen that is stored in the bank,

- data on other values.

Having received the request, the Federal Tax Service is obliged to respond within 7 days. Banks are also obliged to comply with the requirements of bailiffs. This rule is enshrined in Article 70 of the Federal Law “On Enforcement Proceedings”.

If the bank refuses to comply with the request without compelling reasons, this will be considered a violation of the law. Download for free: Sample application to remove seizure from a bank salary card Sberbank, like other credit institutions, is obliged to comply with the requirements of government agency employees.

The bank can refuse FSSP employees only if there are no funds on the client’s card or the account has been previously seized.

Error 404

Info

For this reason, there are frequent cases of withdrawal of capital, the use of which for forced repayment of debt is impossible. If a person is faced with the fact that they have begun to write off funds provided as compensation for the loss of a breadwinner, or other types of income that bailiffs do not have the right to use to force the repayment of debt, it is necessary to urgently file a complaint.

The document is sent to the FSSP.

Can bailiffs withdraw money from a bank card?

Thus, the following types of income are not subject to seizure:

- maternal capital,

- compensation provided to victims of disasters,

- benefits paid to care for a disabled citizen,

- travel money or funds provided in connection with moving to work in another area,

- survivor's pension,

- money paid as disability or injury benefits,

- childbirth benefit,

- a number of other payments.

If a person’s income does not relate to any of the above points, the bailiff can write them off regardless of whether they are stored on the card or in the account. An employee of a government agency charged with executing court decisions cannot always determine the nature of the capital stored in a bank account or card.

Withdrawal of money from the card for debts What to do if the bailiffs withdrew money from the card? In conclusion, let’s look at the instructions for action if money was debited from the card for no reason (it is not clear, to pay a fine or alimony):

- Visit a Sberbank branch and write a complaint about the actions of an authorized employee of the institution.

- The basis for writing a statement is the withdrawal of money without the client’s knowledge. As you know, all operations must be carried out transparently and not infringe on the rights of users.

- Having written a complaint about the work of the bank, you should prepare an application for the actions of the bailiffs (if the person has not received a copy of the writ of execution or other notice from the FSSP employees).

You will have to put in a lot of effort, but with the right approach you can achieve a full return of the written-off funds.

Does the tax service have the right to withdraw money from the card for a fine?

In this case, withdrawing money from the card is unlikely. When bailiffs seize part of the debtor's wages, it should be remembered that the maximum amount is 50% of the monthly amount. Bailiffs do not have the right to withhold more than half of the salary. Does the tax service have the right to withdraw money from the card for a fine? But at the same time, the service is guided by the principles of enforcement proceedings and should not engage in groundless withdrawal of money.

It is important to note that bailiffs actively cooperate with Sberbank. This means that, if necessary, they can obtain all the information about the funds in the debtor’s account, which automatically eliminates the concealment of money. Seized accounts or a blocked card prevents malicious evaders from accessing it.

Error 404

After sending a message about the completion of enforcement proceedings, subsequent debiting of funds from a bank card or account is considered illegal. Video Are banks required to transmit information about the debtor's account? When debiting funds from a client’s card or account, credit institutions are guided by the principle that each person must be responsible for their actions. When borrowing funds, a person must understand that if enforcement proceedings begin, the loan money may also be written off.

Bailiffs work closely with tax authorities and interact with banks.

Withdrawing money from a card for debts

Info

The amount of funds that can be debited from an account or bank card cannot exceed the amount of the debt. If due to a number of reasons more money is withdrawn, its owner has the right to demand a return. In practice, cases sometimes arise when funds are debited from bank cards or accounts without the knowledge of their owner.

If this happens, but the debt has already been repaid, the person has the right to contact the bailiff service with a complaint. Funds written off illegally must be returned. Video Is all of the debtor's capital written off? If a person is interested in whether bailiffs can withdraw money from a credit card, he should know that government agency employees have a similar opportunity, but not all money can be written off.

Can a bank withdraw money from a pension card to settle a debt?

Having received information that the debtor has funds in a certain institution, the bailiff submits to the organization a resolution to write off capital to pay off the existing debt. Having received the document, bank employees are obliged to fulfill its requirements and write off the client’s funds. If there is no capital in a person’s account, the resolution is entered into the card index.

Important

As soon as the funds are received, they will be immediately written off to pay off the debt. Once the capital write-off has been completed and the debt has been fully repaid, enforcement proceedings must be terminated. The bailiff is obliged to send the documentation giving the right to enforced collection back to the government agency that issued it, and send appropriate notices to the debtor and creditor.

Account blocking by the tax office

Pay for answer Do you have an answer to this question? You can leave it by clicking on the Reply button. Similar questions Can a bank withdraw money from another bank’s salary card to pay off a debt? Can a bank withdraw money from a card if I owe one bank and a card from another bank? Can Sberbank withdraw money from a pension card to cover an overdue loan without a court decision? Can the tax office withdraw money from the card to which the pension of a disabled child is transferred without warning, available for a position under an individual entrepreneur. For Issue No. 592563 of June 18, on February 14, 2008, a court decision was made in absentia on eviction without the provision of housing.

Can bailiffs withdraw money from a bank card?

Can the tax office withdraw money from the credit account of an individual? A court decision was made in absentia to compensate another individual for damages. person (damage sustained in an accident by a vehicle). An application was filed to cancel the default judgment, because

the car was insured under extended compulsory motor liability insurance and there was enough money to cover the damage. Without receiving a court decision on the application to cancel the default judgment, the debt for the damage is written off from the credit card. Is this legal? question number No. 3567030 read 49 times Urgent legal consultation8 800 505-91-11 free

- you needed to write an application for suspension of enforcement actions based on the ruling to cancel the default decision.

The bank serving the citizen does not matter either. Money can be debited from an account located in any institution. However, in a number of situations, bailiffs exceed their existing powers, forcing the bank to write off capital. We will talk about the procedure for debt collection, when executors do not have the right to take the debtor’s funds, and the legal regulation of the issue in this article.

- 1 What laws regulate the activities of executive body employees?

- 2 How is capital withdrawn from the debtor’s bank card?

- 3 Are banks required to provide information about the debtor’s account?

- 4 Is all of the debtor's capital written off?

What laws regulate the activities of executive body employees? Collection of funds and property must be carried out taking into account the requirements of current legislation.

Can the IRS withdraw money from a credit account?

- Does the tax service have the right to withdraw money from the card for fines?

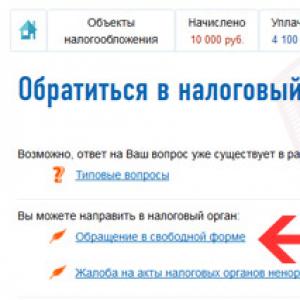

Do bailiffs have the right to withdraw money from a bank card? To do this, you can do one of the following:

- call the bank where the bank card account is opened;

- go to your personal account on the Sberbank website and view information about the grounds for write-off;

- meet with a bank consultant and personally clarify all questions.

- For an unpaid traffic fine;

- for evading payment of alimony;

- for unpaid loan agreements;

- for other debt.

If you have withdrawn money for rent arrears, it is useful to find out whether there is a statute of limitations for utility payments here.

Can the tax office withdraw money from a credit account?

When taking out a loan from a bank, a person must understand that the funds must be repaid. But circumstances may lead to the fact that manipulation becomes impossible. In this situation, the creditor has the right to go to court.

Attention

If the government body satisfies the plaintiff’s request for forced repayment of the debt, it issues a writ of execution, which serves as the basis for contacting the bailiffs. Employees of the organization have extensive powers. However, most people wonder whether bailiffs have the right to withdraw money from a bank card without notice? Employees of the organization have similar powers.

Acting in the interests of the plaintiff who has a writ of execution in his hands, bailiffs have the right to seize property and money stored on the card. Moreover, the fact whether own or credit funds are in the client’s bank account does not matter.

Writing off money from a Sberbank card by bailiffs is currently quite common.

It happens that for the cardholder the loss of money from the account is unexpected. The owner of the bank account has the right to know the legality of this operation.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to know how to solve exactly your problem - contact the online consultant form on the right or call free consultation:

Almost every person can detect that funds have been debited from their account. How to find out, Why did they take money from the card?? First of all, how do you know that they have been removed at all?

It could be:

- notification via SMS to phone, if mobile banking is connected,

- bank card balance request through an ATM,

- balance check through your Sberbank personal account.

Do bailiffs have the right to withdraw money from a bank card?

To the Bailiff Service, in addition to all others, entrusted with the functions of executing court decisions. If a citizen, having received in his hands the court's decision, law-abidingly rushes to fulfill it, then he is not in danger of meeting with bailiffs.

And only in case debtor's evasion from execution of a court decision, the bailiffs get down to business. They organize forced collection of funds based on.

The powers of this service include:

- search for the debtor and his property, including funds in bank accounts;

- seizure of property;

- use of other methods forced collection of debts.

Bailiffs also have the right to request any information from organizations which is necessary for the execution of court decisions.

Information about the availability of bank accounts with the debtor, as well as the availability of money in these accounts, any bank, including Sberbank are required to submit BSC.

How does the bailiff enforce the decision?

If the bailiffs accepted decision to pay off existing debt by writing off finances from the debtor’s accounts, then the writ of execution is sent to the credit institution.

Naturally, this happens if the bank has not only the accounts of the defaulter, but also the funds on them.

If available in the bank several open accounts of the debtor collection will be carried out from everyone, in the amount specified in the writ of execution.

After this forced withdrawal of money, the cardholder finds out that money has been withdrawn from him. What to do? First of all, find out who is the collector of funds. To do this, you can do one of the following:

- call the bank where the bank card account is opened;

- go to your personal account on the Sberbank website and view information about the grounds for write-off;

- meet with a bank consultant and find out all the questions personally.

Reasons why funds may be withdrawn

There are many reasons for withdrawing money without warning. The most common:

- Behind unpaid traffic fine;

- behind evasion of alimony payments;

- behind unpaid loan agreements;

- for other debt.

Check what the money was written off for

For that, to check why the money was withdrawn, you need to visit the nearest Sberbank branch and ask the employees make a printout of your bank card account. All movements of funds on the account will be reflected indicating:

- date, time of the operation;

- receipt or write-off;

- requisites recipient or sender;

- sum of money.

This help will number of the court decision or writ of execution, if the write-off occurred on the initiative of bailiffs. If it is still a mystery to you where the debt comes from, need to visit them.

Bailiffs are required to provide relevant documents on the basis of which your funds have been written off without notice.

How to return if funds were taken by mistake?

You need to go to a bank branch and write a complaint addressed to the head of Sberbank, and state all the details in the complaint.

Provide the bank with a certificate from the bailiffs that you have no debt and the money was withdrawn in error.

In accordance with the rules for returning funds and based on your application, the bank will make a decision and the money will be returned to your account. This will take some time.

Return the withdrawn money for the paid fine

There are cases when bailiffs direct writ of execution to the bank for payment of fines from the traffic police without making sure that the fine has already been paid. The bank is obliged to fulfill order to collect debt within three working days.

The owner of a car and a bank card needs to clarify a misunderstanding and return unjustifiably withdrawn money. A trip to the SSP is necessary. In addition to your passport, you just need to take with you a receipt for paying the fine.

You must submit to the Sberbank branch where your bank card account has been opened, documentation:

- certificate from the bailiffs about the absence of debt,

- notification of an erroneously sent writ of execution,

- application for the return of erroneously written off funds.

Based on the bank's decision, the funds will be returned to your card.

How to return if funds were taken by mistake? You need to go to a bank branch and write a complaint addressed to the head of Sberbank, and state in the complaint all the details of writing off funds from the card. Provide the bank with a certificate from the bailiffs that you have no debt and the money was withdrawn by mistake. In accordance with the rules for returning funds and based on your application, the bank will make a decision and the money will be returned to your account. This will take some time. back to content Return withdrawn money for a paid fine There are cases when bailiffs send a writ of execution to the bank for payment of traffic police fines without making sure that the fine has already been paid. The bank is obliged to execute the order to collect the debt within three working days. The owner of the car and bank card has a need to clarify the misunderstanding and return the money withdrawn without reason. A trip to the SSP is necessary.

Do bailiffs have the right to withdraw money from a bank card?

Attention

That is, the resolution will indicate the offense, the date when it occurred, and other data, thanks to which you can make sure that the fine is yours.

Important

If you do not agree with this fine, you can contact the traffic police directly.

Only according to the law, you can challenge a fine within 10 days after it was issued to you.This can be done in court. But after the case has reached the bailiffs, you first have reason not to pay the fine, and then go to court and seek its cancellation.

Info

The fact is that in court it will be quite difficult to prove that, for example, you did not know about this fine, and most likely you will waste your time and nerves.

It is wiser to think about how to carefully monitor your obligations to the state traffic inspectorate.Fines, taxes

In addition to bailiffs, the following may be involved in withdrawing money from a credit card:

- tax and customs authorities;

- courts of general jurisdiction;

- executive body of the FSFM.

The procedure for withdrawing money for fines or alimony does not require any special measures, since the bank has everything necessary to carry out collection.

Of course, we are talking about access to the debtor’s personal data.

How do bailiffs withdraw money from a Sberbank card? The basis for withdrawing money from the card is a writ of execution from a judicial authority, according to which bailiffs have the right to arrest and confiscate the debtor’s property. The procedure consists of several steps:

- Receiving a writ of execution and sending a copy to the debtor by postal order.

The bailiffs withdrew money from the card without warning

Writing off money from a Sberbank card by bailiffs is currently quite common.

It happens that for the cardholder the loss of money from the account is unexpected.

The owner of the bank account has the right to know the legality of this operation.

- Do bailiffs have the right to withdraw money from a bank card?

- How does the bailiff enforce the decision?

- Reasons why funds may be withdrawn

- Check what the money was written off for

- How to return if funds were taken by mistake?

- Return the withdrawn money for the paid fine

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

Bailiffs wrote off money from a Sberbank card for a traffic police fine

In fact, they have all the rights, but there are a few more nuances and restrictions:

- Bailiffs do not have the right to write off money from clients’ credit accounts, as well as from credit cards, because this is not the debtor’s money, but the funds of financial institutions.

- Every month, the bailiff does not have the right to write off more than half of the debtor’s income if he writes off from a salary card.

But the nuance also lies in the fact that bailiffs are not required to figure out which account they are seizing. That is, they can write off money from a salary card or an account that receives child benefits, alimony, and pensions.

Here you need to protect your rights yourself, that is, go to the bailiff service and provide evidence to lift the arrest.

Withdrawing money from a card for debts

For example, if your salary is transferred to the seized account and the bailiff writes it off in full, then you need to provide a certificate from your place of work indicating the bank account to which the organization transfers the debtor’s earnings. If child benefits are credited to the account, then you need to go to the institution that makes the transfer, for example, if it is social security, then you should go there and provide this evidence to the bailiff. In this option, the funds will be returned to the debtor's account. Please note that if the bailiff violates your rights, then first contact the head of the service, then go to court if the issue cannot be clarified correctly.

To summarize: bailiffs withdraw money from a Sberbank card without warning, and this is their legal right.

13.03.2014The Bailiff Services (BPS) write off... But, to the chagrin of the debtors, not the math homework. According to SSP regulations, real money can be collected remotely from the bank cards of defaulters.

Whose side is the law on?

User comments:

Maria

Alfa Bank likes to write off money from credit cards, essentially taking out a loan in your name.

Maria, no credit institution writes off funds from your card without reason. If any write-off occurs, it is necessarily stipulated by the terms of service and tariff plan for the card, which must be studied in advance in order to avoid unforeseen situations.

Maria

I'm in SHOCK. Here is my SITUATION. Alfa Bank employees withdrew funds from my husband’s CREDIT card by decision of the bailiff. Those. the bank took out a loan in his name from his credit card without his knowledge. As I understand it, the credit card contains bank funds that the Bank is ready to provide to the client on credit. He did not take the amount that the bank transferred without my husband’s knowledge to the bailiffs from the bank. He did not give his consent to the transfer of funds. The bank calls his friends and smears his name. My husband is not obliged to take out a loan to pay debts to the bailiffs. I consider the bank’s actions immoral and illegal. Alfa Bank did not notify my husband about the arrival of the writs of execution in his name. Citizens, if you want to wake up with a loan unknown to you, open accounts with Alfa Bank

Maria, the Bank did not take out a loan in the name of your husband; the funds from the credit limit are presented for his use on the basis of a corresponding agreement signed by him. The write-off of funds by the Bailiff Service occurs on the basis of a court order, which is subject to execution by the Bank without acceptance.

Please note that in the Federal Law of the Russian Federation of October 2, 2007 N 229-F “On Enforcement Proceedings”, in Article 69 on the procedure for levying execution on the debtor’s property it is stated “Foreclosure on the debtor’s property under executive documents is addressed primarily to his funds in rubles and foreign currency and other valuables, including those in accounts, deposits or storage in banks and other credit institutions, with the exception of the debtor’s funds held in trading and (or) clearing accounts.” Thus, this law does not contain exceptions for credit cards.

However, you can still contact the Bank, get a certificate stating that this card is a credit card and familiarize the bailiffs with it. There are precedents for the return of credit funds to the debtor’s card, subject to repayment of the debt from other sources.

Daria

Please tell me whether the remaining loan debt was written off from the card. The card went negative. If I don’t have the opportunity to go to the bailiff at my place of residence and I top up the card and pay off the debt minus the debt will be paid? Or do you still need to go to the bailiffs?

Maria

The funds on the credit card are not the debtor’s property, they are the bank’s funds that it agrees to provide to the client. But the client, having a credit card, is not obliged to use it! So in this situation we are not talking about the debtor’s property, but about the bank’s property. That is, the Bank is ready to lend me money, and I decide for myself whether I want to take it... There is a reason to close all credit cards, it’s not a safe matter.. In general, Pavlov’s reform is double two. We will repay the loan to Alfa-Bank within 2 months... and will forever sever relations with such a “bank”! We advise other clients to think carefully... is it worth dealing with a bank that does not keep information about the client... And get a reliable safe and alarm system. I can say for sure about myself that I will not have any relationship with a group of banks that has entered into an agreement with bailiffs, it is not safe. And bailiffs very often make mistakes...

Maria

Natalya, as an employee of the banking sector, answer the question: who owns the funds on the credit card?

Maria

Your advice to contact the bank for a certificate is of course good, but just answer, why do I need this... Open a credit card, and then live and think every minute... when the bank will once again write something off from it without my consent.. .and I’ll be stuck around for 2 months with the certificates, I have nothing to do with myself... Isn’t it easier to just break off relations with the bank and sleep peacefully???

Daria, in theory, if the debt for which a decree was issued from the Bailiff Service is repaid from your card, then you will only have to pay off the current debt by making at least the required monthly payments.

However, I would still advise, in order to avoid any misunderstandings, to contact the Bailiff Service and clarify whether the overdue debt has been repaid in full.

Maria, of course, initially the funds on the credit card belong to the bank and are provided to the borrower for temporary use. In this case, I completely agree with you. However, the legislation in the Russian Federation is written in such a way that it can be read in a way that will benefit everyone.

It turns out that since the law does not contain exceptions to the effect that credit cards are not subject to collection, funds can be used to pay off debt on them as well (“what is not prohibited is permitted”). Moreover, when responding to a request from the Bailiff Service about the availability of the debtor’s accounts, the credit institution may not indicate that this card is a credit card (this is beneficial for the bank, because it becomes possible to receive income in the form of accrued interest on the amount of the spent credit limit).

Therefore, if you do not fight for yourself, no one will help you with this, at least until such time as unambiguous legislative acts appear that will regulate this or that activity in our country.

In general, I advise you to prevent such situations from arising and, if you have any debts, pay them off within the prescribed time frame.

Sonya

And if I have a large loan and only have bread to pay for living, and I have debt for utility bills, which I don’t use, because... It is impossible to live at the place of residence due to the terrible condition of the house. The house is called bomzhatnik or chudilnik. I've been living in an apartment for 20 years. By the way, I took out a loan for treatment. Because All the money goes to pay for the rented apartment. And if they withdraw money from the card, then I will remain on the street and will not be able to pay the loan.

Sonya, unfortunately, when issuing a court order to write off debts from accounts and cards, the so-called “human factor” is rarely taken into account. Today, many people are in difficult financial situations, but “the law is the law.”

You are required to pay utility bills; if you do not live in the house, you could contact the relevant services with a request to temporarily shut off the supply of water, gas, etc. It is assumed that before making a decision to obtain a loan, you should rationally weigh the pros and cons and assume what consequences such a decision may entail.

Tatiana

I am a disabled mother of many children. I have a credit card with Sberbank on a plastic card, but I also have another card on which I receive alimony for my minor children. The bailiffs placed arrests on my accounts, but I provided them with documents on the basis of which they removed these arrests from the account and sent resolutions to Sberbank. But Sberbank wrote off my children’s income in favor of my loan debt. Tell me how I can legally collect my children’s income. How should I proceed?

Tatyana, to resolve this situation, you need to contact directly the branch where you received the loan or credit card. As a rule, service agreements contain a clause according to which the credit institution has the right to write off funds to repay the debt from other accounts opened with this bank. Therefore, from a legal point of view, the Bank is acting legally. If you have temporary financial difficulties and it is not possible to make monthly payments, you can contact the Bank branch with an application to restructure your credit debt or refinance it.

Denis

Please tell me which organizations, other than the FSSP, have the right to issue a foreclosure to the bank.

The fact is that my Sberbank card was seized for the amount of heating debt. There was no paperwork at the FSSP, and the FSSP did not make a request.

The bank branch provided me with “Information about arrests”, which indicated that the Collection was issued by the organization MUP “KaliningradTeploset”. Neither the bank nor the company notified me about the collection.

in turn, I do not recognize the debt legally (but that’s another story). Please explain to me: are the actions of the bank and the enterprise legal? What laws did they use and/or break?

Thanks in advance,

Denis, no municipal unitary enterprises or other legal entities have the authority to seize the debtor’s property. In any case, the case of non-payment of funds must be referred to the court and after its consideration, depending on the decision of the judge, one or another decision is made, which is subsequently transferred for execution to the Bailiff Service.

Alexandra

Please tell me. I needed to pay transport tax, after a while the FSSP seized my debit card. That is, the card went into minus by the amount of debt. After that, I put money on the card, the balance became positive. Can my debt be considered repaid?

And one more thing, before the full amount was deposited on the card, I deposited a small amount, part of which the FSSP wrote off as a debt. But when I later deposited the entire amount, I discovered that they had sown the entire amount as originally. What should I do in this case, will there be a recalculation of the withdrawn amounts?

Alexandra, in this situation you need to contact the Bailiff Service. It all depends on the nature of the seizure order, that is, it was simply a seizure for a certain amount, or a demand was made for payment of tax, the amount of which was written off to pay off this debt.

If the amount on the card was simply blocked, then it is logical that when funds were received on the card account, the required details were debited.

When you contact the Bailiff Service, you will be able to find out whether your debt has been repaid and whether there is an overpayment on it.

Sophia

Good evening, please tell me

I am a guarantor, the loan was not paid, the debt is now on me, credit cards are blocked, will the salary card be blocked, and does the resolution apply to mortgages and new deposit accounts?

Sofia, in the Federal Law of the Russian Federation of October 2, 2007 N 229-F “On Enforcement Proceedings”, Article 69 on the procedure for foreclosure on the debtor’s property states “Foreclosure on the debtor’s property under enforcement documents is applied primarily to his funds in rubles and foreign currency and other valuables, including those in accounts, deposits or storage in banks and other credit institutions, with the exception of the debtor’s funds held in trading and (or) clearing accounts.”

Thus, if there is overdue debt under a credit agreement, a seizure will most likely be imposed on all your accounts and cards. It’s not entirely clear what you mean when you ask “does it apply to a mortgage”? A mortgage is a mortgage loan that cannot be foreclosed on.

In this situation, I advise you to repay the overdue debt, after which the seizure will be lifted, and then use banking products as usual.

Vasek

I remember I took a savings account from my credit card.

There was a card with a limit of 60,000, which was exhausted a long time ago.

But this was no problem for the bank - they withdrew 20,000. The minus 20,000 light appeared on the credit card.

I called the bank with a question - “What kind of business is this? Who’s on.”

The problem was solved in a couple of minutes. They sent me to the bailiffs, and the card limit was increased to 80,000.

Moreover, they were withdrawn from two cards at once. There was also a salary, it was also driven into the minus.

Damir

My money was debited from my savings card for tax. But the debt has not decreased. Two months have passed. What should I do?

Elena

Please tell me, according to the bailiff's writ of execution, money was written off from the mortgage account, an amount greater than the mortgage payment itself. We pay the mortgage on time, monthly, but the bank called and said, you have a mortgage debt of 20,000 rubles. We are shocked. Firstly, there were no notifications, and secondly, we are fulfilling the agreement with the bank regularly. It turns out that the Bank no longer gave our money from this mortgage account, but its own. What to do in this case? I have nowhere to get these 20 thousand and pay for the mortgage. Income close to one month's subsistence.

Elena, according to the decision of the Bailiff Service, the funds were most likely not written off from your “mortgage account”, because There are no such accounts, but from a current account to which you deposit funds, after which they are automatically debited to the account for recording your loan debt.

Thus, it was your funds that were written off from this account, and not the Bank’s funds, but now there are no funds to repay the monthly payment on your mortgage loan and, accordingly, a delay may occur, which will entail the accrual of penalties and fines.

To resolve the situation, you need to contact the Bailiff Service; in this case, the Bank is only the executor of the order to write off funds.

Maxim

There was a consumer loan of 200,000 rubles. I paid half as soon as I lost my job! Three years have passed, now the debt weighs on the bailiffs website 170,000 rubles. I want to ask what to do? How to reduce the debt or not pay it at all... it will be written off sooner or later.

Maxim, I do not advise you to “throw away” your debt and hope that sooner or later it will be written off. You must be responsible for your obligations. To resolve the issue of closing a loan agreement, you can go to court, by decision of which the amount of interest, penalties or other penalties may be partially written off, as well as a schedule for repayment of overdue debt may be determined.

Ksenia

Hello, please tell me, I have applied for alimony, I need to go to the bailiffs, can they write off money from the card to which alimony will be transferred if there is arrears on the loan, but there has not been any court order yet.

Ksenia, funds are debited from the account in a certain order of priority established by the legislation of the Russian Federation.

For example, Article 855 of the Civil Code of the Russian Federation defines the following: “If there are insufficient funds in the account to satisfy all the requirements presented to it, funds are written off in the following order: first of all, according to executive documents providing for the transfer or issuance of funds from the account to satisfy claims for compensation for harm caused to life and health, as well as claims for the collection of alimony; secondly, according to executive documents providing for the transfer or issuance of funds for settlements for the payment of severance pay and wages with persons working or who worked under an employment agreement (contract ), for the payment of remuneration to the authors of the results of intellectual activity; thirdly, for payment documents providing for the transfer or issuance of funds for settlements of wages with persons working under an employment agreement (contract), instructions from the tax authorities for the write-off and transfer of tax arrears and fees to the budgets of the budget system of the Russian Federation, as well as instructions from bodies monitoring the payment of insurance premiums to write off and transfer the amounts of insurance contributions to the budgets of state extra-budgetary funds; fourthly, according to executive documents providing for the satisfaction of other monetary claims; fifthly according to other payment documents in calendar order."

Thus, because Since the payment of alimony is a write-off of the first priority, and the repayment of credit debt is a fourth priority, then the transfer of alimony will be carried out first.

Igor

Hello There are 180 thousand rubles in the bank account. The debt to the bailiffs is 32 thousand, they completely blocked the account and the car. I wrote a statement to the bailiffs asking them to write off the amount of my debt from the blocked account. They refused. They said that only after payment from outside will they unblock the account. What can I do?

Alina

Hello! At work a year ago, along with a salary card, they gave me a Sberbank credit card with an approved limit of 100 thousand. I didn’t draw up any documents with the bank myself (apparently the accounting department did it for all the company’s employees independently). At the same time, at work they explained that you don’t have to be afraid of anything if this is a loan. Do not use the card, it will be canceled on its own. Now I have a question: bailiffs can seize my accounts, etc., to enforce a civil court decision. Everything is clear with a salary card, but this imposed credit card, which I did not use, can also withdraw the amount of 100 thousand from it. for which it was issued and then I will also owe Sberbank??? And is it enough to cancel it, just block it in your Sberbank-on-line personal account??? Please help me with the answer, this is very important to me!

Igor, bailiffs can, depending on the situation, seize the debtor’s account or submit a payment demand for the need to collect a certain amount. Most likely, in this situation, it was the first option that was used, and your accounts were simply seized, blocked for carrying out debit transactions without presenting a demand for payment.

Thus, you need to either pay off the existing debt from external sources, after which the arrest will be lifted, or contact the bailiffs with a question about issuing a payment request to your account.

Alina, indeed, by order of the bailiffs, funds can be written off from any accounts/cards of the debtor, regardless of their source of origin. Please note that in order to correctly close a credit card, you need to go to a Bank branch with your passport and fill out the appropriate application.

16.01.2017

Natalia

Hello, please tell me, due to the loss of his job, my husband has arrears in alimony payments, he doesn’t refuse to pay them off now, but in his name there is a loan to Sberbank, I pay it through the card on time, but today I received an SMS that the money was written off as alimony debt and now I have a debt to the bank . What should we do?

Natalya, all banks have a priority order in which payments are written off from cards if there are several requirements at the same time. For example, alimony arrears are higher on this list than loan debts, and the bank has the right to write off such debts from any accounts and cards opened with a given credit institution.

Thus, until the alimony debt is repaid, the loan debt will need to be repaid by directly depositing funds into the loan account through the bank cash desk.

27.01.2017

Olga

Hello, please tell me if, due to arrears in alimony, the inspector of the executive service has blocked the account. The debtor is ready to repay the debt, but does not have access to funds. What solutions to the situation are possible?

Olga, in this situation, the debtor-account owner needs to contact the Bailiff Service so that, along with the seizure order, a payment request for the transfer of funds to the relevant details is also issued. After such a request is sent to the bank and fulfilled, the arrest from the account can be lifted.

10.02.2017

Gulfiya

Hello. I have a transport tax for quite a small amount. My Sberbank card was seized a long time ago. Now life’s difficulties are like everyone else’s, I have the opportunity to take out a Tinkoff Bank credit card. They can seize it and withdraw money from it. Then I won’t be able to pay off the loan or pay off the tax.

10.02.2017

Nikolay

Hello! Please tell me, I have two debit cards from Sberbank of the Russian Federation, on one card the balance was 0.00 rubles. on the other 96 rubles. I blocked both cards because... there is no need for them anymore, but these cards are still valid until 2018. Recently I received an SMS from Sberbank of the Russian Federation that my cards were seized by a bailiff and these blocked cards were put into the minus, is this legal?

Nikolay, the fact that you have blocked your cards does not mean that the card accounts are no longer valid, you just cannot carry out debit transactions using them. To correctly close the cards and terminate the banking service agreement, you had to submit a corresponding application to the Bank branch.

05.04.2017

Alexander

Natalia! Here's the question: funds on a credit card were blocked to pay off utility debt. The decision was from September 2016. I paid off my debts in December 2016. A copy of the payment slip remains. Funds for the same debt were blocked in April 2017. What documents do I need to collect and who should I contact?

06.04.2017

Mark

Greetings to everyone)) The following situation has arisen: the bailiff withdrew the amount from the debit card, thereby driving me into debt to Sberbank, and the debts were never repaid.... how do you even understand this?

P.S/ - I have not received any notices about judicial execution!!!

Mark, to find out the reasons for blocking your card, you need to contact the Bailiff Service. Please note that in some cases, accounts and cards are simply blocked in order to make it impossible to carry out debit transactions, and sometimes bailiffs also receive a payment request to repay the debt and transfer this amount to the necessary details. In any case, you can only obtain accurate information by contacting this authority in person.

21.04.2017

Diana

Hello, money was withdrawn from my Sberbank card for not paying transport tax without any warning, do bailiffs have the right to do this?!