VAT 0 10 18 percent. For dummies: VAT (value added tax). Tax return, tax rates and VAT refund procedure. What is VAT

VAT is one of the most significant taxes in the Russian Federation. It replenishes the country's federal budget. VAT is considered an indirect tax. It falls on the shoulders of the end customers. Those. The more intermediaries (more precisely, the intermediary price) there are between the producer and the consumer, the higher the state income. No one thought, maybe this is why the state is so actively eliminating “outbidders”? But that's a completely different topic. We will talk in more detail about VAT 10 percent (the list of goods taxed at this rate). But first, let’s talk about how the tax came about.

The history of the appearance of tax in Russia

In our country, VAT has been in effect since 1992. Before this, there was a sales tax.

But such a measure legally exempted many subjects from payment. Then the government introduced VAT.

It was then regulated by a separate Federal Law, which was called “On Value Added Tax.”

In 2000, the law was “merged” into the Tax Code. The basis of the collection was taken from the USA. But at the moment, almost all countries apply a similar principle for calculating it. Only the rates differ.

Was it good before?

For those who like to criticize modern “exorbitant taxes”, as well as “sentimentalists” who claim “how wonderful it used to be,” let’s say that from 1992 to 1993 the tax was 28% (a VAT rate of 10 percent looks fantastic against this background). From 1994 to 2004 the rate was reduced to 20%.

Of course, one can argue that “there were no other taxes.” But at this time, personal income tax was also reduced to 13%. At that time, “everyone was coming out of the shadows.” The state reduced rates because the majority preferred not to pay anything. The impotence of law enforcement and tax services, coupled with high stakes, explained the reason for this behavior. Maybe “admirers of the past” remembered this, without paying absolutely any fees.

Where did VAT come from?

For the first time, such a tax appeared in France in 1942 (war is war, and private property is above all). But it did not take root, because it had many shortcomings.

It was a kind of sales tax. In 1948, French economists modified it. They created accrual principles that appealed to the whole world (or rather, authorities in all countries, because who likes paying taxes?).

What is VAT

VAT is a type of indirect tax on goods or services at the time of sale. It is taxed at all stages of production and ultimately falls on the consumer.

That is, the higher the “appetites” of producers, the more profitable it is for the state. For example, you were sold chicken in a store. Its cost was 50 rubles. And the buyer paid 200 rubles for it. A percentage of 150 rubles (200-50) will have to be paid in the form of If the seller had been “generous” and the goods “had been given for what he took”, i.e. had not added anything to the original price, then the state would not have received a penny from such a deal.

It doesn't matter whether the company is making a profit or operating at a loss. VAT is not cancelled. Hence the conclusion: the more they cheat, the better the federal budget. Let's think about whether the state really needs to limit the arbitrariness of intermediaries. With such a system, on the contrary, their growth is only beneficial to the budget. Now let's move directly to which the amended Tax Code (2015 edition) establishes.

How much do we pay to the state?

How to determine how much the government will take from the price increase? The 2015 Tax Code provides for three rates: 18% (standard), 10% (preferential) and 0% (customs). VAT rates of 10 and 18% are “internal”.

They apply to domestic countries only. If they are exported outside the country, no tax is charged. If you pay VAT when purchasing a product and reselling it abroad, the tax paid is refundable.

VAT rate 10 percent: list of goods and services

18 percent is the regular VAT rate. However, there is a list of goods that reduces it to 10. Many entrepreneurs ask the question: “In what cases is 10% VAT applied?” Let's try to answer it.

The VAT rate is 10 percent, the list of goods and services assumes the following:

- Domestic air transportation.

- Childen's goods.

- Some medications.

- Periodical printed materials.

The list of all goods was approved by Government Decree No. 908 of December 31, 2004. It is in this document that the entire list is indicated, which is subject to VAT of 10 percent. The list (brief) is given below:

- Milk and dairy products.

- Meat in live weight.

- Eggs.

- Cooking fats, vegetable oil.

- Salt.

- Flour and pasta products.

- Vegetables.

- Children's and diabetic nutrition, etc.

“My product was missing”

If your product is not on our list, and you have a question: “In what cases (or rather, to what goods and services) is VAT applied?”, you need to look at the Resolution. We have already indicated the number and date. It contains a complete list. As a rule, these are all groups of goods that are in high demand among citizens.

VAT rate 10 percent: air transportation

In connection with the economic crisis, legislators supported the request of air carriers to reduce VAT to a “preferential” 10 percent. On April 1, 2015, the Federation Council approved this bill and approved the benefit from July 2015 to December 2017. Most likely, this period will be extended if the economic situation does not improve.

Everyone is dissatisfied

This law did not satisfy anyone. The government due to the fact that it began to receive less money due to the budget deficit. Air carriers say this will not solve the industry's problem.

The head of Aeroflot, Vitaly Savelyev, expressed dissatisfaction with this matter. He believes that in the current situation it is necessary to completely remove VAT from air carriers on domestic flights. The situation turns out to be that it is almost cheaper to get from Vladivostok to Moscow on a “round-the-world trip”.

Is Crimea ours?

An interesting situation concerns Crimea and Sevastopol. Referendum, annexation - we all know this very well. But as far as legislation is concerned, not everything is so simple. So internal regulations make us think - is Crimea ours? Russian?

This concerns the law on amendments to the Tax Code in 2015, according to which domestic air transportation is subject to a preferential tax of 10%. The same regulatory legal act contains the wording, “except for trips to Crimea and Sevastopol.”

Apparently, Russian companies are afraid of possible economic sanctions “from recognizing” Crimea as Russian territory. For this purpose, similar regulations on tariffs, taxes, etc. are adopted. Companies do not violate domestic law and are not subject to international sanctions.

10+10=28?

In the section “VAT rate of 10 percent: list of goods and services,” we said that there is a category of socially significant goods that have a VAT exemption. The full list of codes and names is prescribed in Decree of the Government of the Russian Federation of December 31, 2004 No. 908.

But what to do when the product is “at the junction” of two items. In addition, situations seem paradoxical when the products sold consist entirely of “preferential” goods, but are subject to 18%.

For example, pizza. It may consist entirely of those products that are eligible for the benefit. Flour, eggs, meat, cheese, etc. But the “combination” of these “social” products into a “delicacy” pizza is taxed “to the fullest.”

This provision is clarified by letters from the Ministry of Finance dated September 10, 2010 No. 03-07-14/63 and the Federal Tax Service for Moscow dated March 16, 2005 No. 19-11/16469. According to them, VAT of 10 percent is charged on the sale of goods that are included in Government list. The rest fall under 18%.

This list includes the category “pies, pies, donuts,” as well as meat, various cereals, and vegetables. But there is no such thing as “empanadas” or “pizza.” Here officials apply the principle “what is not permitted is prohibited.” They believe they should pay the full 18 percent for spring rolls.

Pizza or Italian pie

But there is one "loophole". If you want to produce pizza and receive VAT benefits for it, then you can sell it as an “Italian” pie. It is enough to have all the certificates for the conformity and quality of the products. No one will prevent you from replacing the name of a product from “pizza” to “pie”; the law does not establish “what should be” in each of these products. The main thing is to indicate the composition of the product.

The arbitration court is on the side of entrepreneurs

In addition, entrepreneurs use code classifiers that mean “bakery products” for pizza, as well as “meat and meat products” for stuffed meat pancakes. Both of these codes "allow" 10 percent to apply.

Such a “trick” can lead to arbitration. Tax authorities dispute the rate of 10 percent, insisting on 18. But arbitration practice is often on the side of entrepreneurs, because according to GOST “Public catering services. Terms and definitions”, approved by order of the State Standard of Russia dated November 30, 2010, flour culinary products include pies, belyashi, and pizza. And these products contain various fillings.

Rate 18/118 VAT provided for the circumstances specified in paragraph 4 of Art. 164 Tax Code of the Russian Federation. Except rates 18/118 VAT, which is considered calculated, its other size is also considered in this capacity - 10/110 VAT. Our material will discuss the current tax rates, the formulas used to calculate the tax, as well as the circumstances in which estimated rates are generally applied.

What are the current VAT rates?

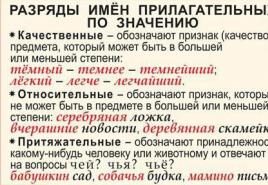

In the total number of rates used to calculate VAT, there is a conditional gradation into calculated and basic. The latter, in turn, are divided into 3 categories:

Zero rate (0%) - the circumstances under which taxpayers have the right to apply it are stipulated by the norms of paragraph 1 of Art. 164 Tax Code of the Russian Federation.

10 percent rate (10%) - the circumstances of its use are determined by the rules contained in paragraph 2 of the same article.

18 percent rate (18%) - applied according to the rules contained in paragraph 3 of this article.

VAT rate 18% should be applied in those circumstances when there is a sale of goods, works or services not mentioned in paragraphs. 1, 2, 4 tbsp. 164 Tax Code of the Russian Federation. Since the list is very narrow and cannot be expanded, it turns out that most domestic transactions should be subject to an 18 percent tax.

What formulas are used to determine the settlement rate?

The estimated rate can be determined using simple formulas. On the one hand, it would seem simple to calculate the tax - you should apply tax rates of 10% and 18% VAT, calculating the percentage ratio with their help. However, in accounting practice, to determine rates, formulas are used in which, in addition to percentages, you need to know the size of the tax base. The calculation is carried out using an elementary formula: the percentage value is divided by the sum of 100 and the percentage value.

In numbers these formulas look like this:

for a 10 percent rate: 10 / (100 + 10);

for an 18 percent rate: 18 / (100 + 18).

This procedure not only follows from accounting practice, it is also approved in paragraph 4 of Art. 164 Tax Code of the Russian Federation.

When are settlement rates used?

Here are the circumstances when the described rates are necessarily applicable.

Cash settlements

Norms of paragraph 4 of Art. 164 of the Tax Code of the Russian Federation defines a list of circumstances when the described rates are mandatory for use.

1. When the taxpayer receives money as part of payment for transactions. The list of such operations is provided in Art. 162 of the Tax Code of the Russian Federation.

There is one peculiarity here. Its essence is that if amounts are received in addition to revenue, then they will also have to be taxed, and at the same rate as for the main transaction. For example, if the principal amount was taxed at 18%, then a settlement rate of 18/118 will be applied to all monetary additions within one contract.

2. Estimated rates are applicable in the following circumstances:

when advance payments are received for the upcoming sale of goods or transfer of rights to property.

when VAT is withheld by the agent.

Sale of property

The calculated rate must be used when selling movable and immovable property. This rule is contained in paragraph 3 of Art. 154 of the Tax Code of the Russian Federation and has a nuance: property taxed at this type of rate must have been previously acquired externally. Here it is possible to use the formula with both a 10 percent tax and an 18 percent tax, i.e., rates of 10/110 and 18/118 are possible.

Here is a small list of property included in this category:

fixed assets purchased with money from budget sources;

property transferred to the taxpayer as a gift and recorded on the balance sheet, taking into account the VAT contributed to the budget by the previous owner.

fixed assets recorded on the balance sheet at a price including VAT;

passenger cars, as well as minibuses, which are used for business trips and are recorded on the balance sheet at cost with this tax included.

In addition, the estimated rate should be used when assessing:

operations during which agricultural products and their derivatives obtained as a result of processing are sold;

cars purchased from individuals, if such cars are subsequently resold;

transactions for the transfer of rights to property.

Let us note that the list established by law does not allow additions, i.e. it is closed.

How are invoices with estimated rates prepared?

When selling property, the price of which includes VAT, the taxpayer is obliged to use the rules for filling out an invoice, approved. by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. At the same time:

in gr. 5 reflects the difference between prices including tax;

in gr. 8 the estimated tax amount is entered.

If the operation is not related to the sale of property, then in gr. 7 indicates the calculated rate used without the “%” sign (i.e. “10/110” and “18/118”).

When calculating the tax payable, it is necessary to take into account the types of VAT. Depending on the object of sale, the tax percentage may vary. The tax rate is necessarily prescribed in the basis document to determine the payment required to be paid to the state budget. Such a document is an invoice. Its form is regulated by law. The tax rate is indicated in the documentation as a separate line. If an error was made on the invoice, a correction document must be issued.

There are three VAT rates in the Russian Federation: 0, 10 and 18%. Let's consider in what cases at what percentage the tax payment will be calculated.

When is 0% VAT used?

The most commonly used VAT is 0% when exporting and selling products intended for transit through Russia. This list includes:

- products intended for export outside the customs territory of Russia, as well as products moved under the customs regime (in a free zone);

- provision of services or performance of work related to the sale of products intended for export, as well as organizing the movement (escort, loading, etc.) of these products if they are imported into Russia or exported abroad;

- provision of services related to the transportation of passengers, as well as their luggage (the main condition is the location of the point of departure or destination outside the borders of the Russian Federation);

- carrying out work or performing services that are related to the transportation or movement of something through the territory of Russian customs, as well as products placed under the customs regime.

The listed services can be provided under foreign economic agreements with Russian counterparties, non-residents, as well as under intermediary agreements. It does not matter the type of vehicle or the method of organizing transportation.

In the reporting declaration for the quarter, financial and economic movements at a 0% rate are displayed on a separate page (section 4).

VAT 10 percent: list

Many products sold fall under the 10 percent VAT list. Thus, VAT of 10% is paid to the budget for operations regarding:

- food products (livestock, poultry, meat products, dairy products, butter, margarine, salt, sugar, grain, feed mixtures, seafood, vegetables, baby food and other goods);

- products intended for children (knitwear, clothing and footwear, bedding and beds, strollers, diapers and other goods for preschool children);

- products intended for school-age children (pencil cases, plasticine, stationery, diaries, notebooks, sketchbooks and other goods);

- periodicals (with the exception of publications that are advertising or erotic in nature);

- literature with a scientific focus or published for educational purposes;

- goods intended for medical purposes from domestic and foreign manufacturers;

- pharmacological agents, including drugs intended for clinical trials;

- breeding livestock and poultry.

VAT 18% is paid by the taxpayer to the budget if his activities do not fall into the above lists, where a reduced preferential rate applies.

Transactions at rates of 10% and 18% are displayed in the reporting declaration in section 3. The same section displays estimated rates.

Estimated VAT rate - the value added tax rate of which VAT is calculated from the amount of income with tax included in it: 18/118 or 10/110.

The Russian Tax Code sets VAT rates, which determine the tax based on the sales price excluding tax. For example, if the VAT rate is set at 18%, then if the cost of selling a product is 100 rubles, the VAT will be 18 rubles (100 * 18%).

In some cases, legislation provides that VAT is calculated on income that already includes VAT (for example, when receiving an advance). In this case, VAT is calculated in reverse, at the calculated rate (for example, 18 / 118). For example, if VAT is calculated on income of 236 rubles including VAT, then VAT using the estimated rate will be 36 rubles (236 * 18 / 118).

A comment

In general, there are three VAT rates – 0%, 10% and 18%. To calculate VAT, a rate is applied to the amount of the tax base (excluding VAT).

Example

The taxpayer sells goods at a cost of 50 thousand rubles excluding VAT. The tax rate for such sales is 18%.

The VAT amount will be: 9 thousand rubles (50 thousand * 18%).

For some cases (they are specified in paragraph 4 of Article 164 of the Tax Code of the Russian Federation), VAT is calculated in the reverse way - the tax is calculated from the price of goods (work, services) including VAT. So, if the tax needs to be calculated on the amount of 59 thousand including VAT, then you need to apply to this amount not a rate of 18%, but a rate of 18/118:

59 * (18/118) = 9 thousand rubles.

This rate (18/118 or 10/110) is called the settlement rate. It is applied in cases where the tax, in accordance with the Tax Code of the Russian Federation (Tax Code of the Russian Federation), is calculated from the tax base already formed including VAT. There are few such cases and they are listed in paragraph 4 of Art. 164 Tax Code of the Russian Federation:

1) upon receipt of funds related to payment for goods (work, services) provided for in Art. 162 Tax Code of the Russian Federation;

2) upon receipt of advances against the upcoming delivery of goods (works, services), transfer of property rights;

3) when tax is withheld by tax agents;

4) upon the sale of property accounted for VAT in accordance with clause 3 of Art. 154 Tax Code of the Russian Federation;

5) when selling agricultural products and their processed products in accordance with clause 4 of Art. 154 Tax Code of the Russian Federation;

6) when selling cars that were purchased for resale from individuals, in accordance with clause 5.1. Art. 154 Tax Code of the Russian Federation;

7) when transferring property rights in accordance with clauses 2-4 of Art. 155 Tax Code of the Russian Federation.

Example

The taxpayer received an advance payment for the supply of goods subject to VAT at a rate of 18% in the amount of 200 thousand rubles.

The amount of VAT payable on the advance amount will be: 30,508 rubles (200 thousand * (18 / 118)).

Example

The Bank, in accordance with its accounting policy, takes into account VAT in the cost of acquired property (clause 5 of Article 170 of the Tax Code of the Russian Federation). The bank purchased a fixed asset for 59 rubles (including VAT of 9 rubles) and, without putting it into operation, sold it for 118 rubles including VAT.

VAT = (118 – 59) * (18 / 118) = 9 rubles.

To calculate the VAT amount you can use

Among the variety of taxes and fees intended for mandatory calculation by business entities, VAT occupies a special place. The specificity of this tax lies in the complexity of its correct calculation, and in the ambiguity of the interpretation of the provisions of Chapter 21 of the Tax Code, which is subject to regular changes.

Over the 25 years that have passed since the introduction of the Law on Value Added Tax, many legal provisions relating to VAT have been subject to serious revision.

But over the past 10 years, the current tax rates listed in Article 164 of the Tax Code of the Russian Federation have remained stable.

When and who is required to pay VAT?

The definitions given by the Tax Code of the Russian Federation fix the indispensable participation in the formation of the budget at the expense of VAT in specific situations:

- provision of services, sale/transfer of goods or the right to use assets under any form of agreement;

- performing construction, installation or equivalent work;

- the above-mentioned works, services or transfer of valuables for personal use;

- importation of goods or products from abroad.

Subjects for mandatory VAT payment are:

- organizations or individual entrepreneurs engaged in commerce or production using OSNO;

- non-profit companies – in case of realization of rights to property;

- banking and insurance structures;

- separate divisions and branches of organizations that sell services or products;

- customs intermediaries.

Why is VAT needed?

The very name of the tax implies that a share of the added value arising at all stages of the sale of one’s own products, goods purchased for resale, or services provided is withdrawn from the budget. This is how the main function of VAT is implemented - fiscal.

If you trace the chain from the manufacturer of a product to its final buyer, it turns out that the process of shifting the tax will end only at the moment the product is purchased by the consumer who is the last in this scheme. The regulatory function of VAT is manifested in the formation of the consumer market, since the real payer of the tax is not an LLC or individual entrepreneur, but a living buyer.

VAT, as a regulator of the consumption market, cannot be too high, since in this case, due to extremely high prices, the demand for goods and services will fall. This factor will invariably lead to a weakening of the economic position of both individual business entities and industries as a whole.

VAT rates

Art. 164 of the Tax Code of the Russian Federation determined the use of several percentage tax rates - 0%, 18% and 10%. The law clearly spelled out cases of possible application of one or another tax rate. In addition, tax legislation stipulates the circumstances when the amount of VAT is calculated by calculation.

When is VAT 0%?

Taxing at zero rate provided for LLCs or individual entrepreneurs engaged in clearly defined types of activities:

- transfer of energy resources outside Russia;

- international transportation of goods and passengers with luggage;

- transportation of gas and oil;

- transportation of passengers and cargo in railway cars that are on the balance sheet of the organization;

- services provided by water transport;

- work related to space activities;

- air transportation of people and luggage to Crimea and Sevastopol from March to December;

- movement of goods across the Russian border.

Important: To legally use the zero VAT rate, a transport expedition agreement must be drawn up instead of a standard agreement on the transportation of goods.

Tax authorities give the opportunity to entities that have indicated in their declarations revenue from preferential customs operations at a 0% rate, within six months confirm your right relevant documents. These include:

- photocopies of contracts with foreign partners;

- goods or shipping waybills;

- register of customs declarations or individual declarations.

The six-month period for collecting supporting documents begins from the moment the cargo crosses the border and the corresponding mark is placed on the accompanying papers.

If the taxpayer does not provide the established package of documents to the tax authority, then revenue from the provision of international transport services will be taxed at the standard rate of 18%.

Options for using a reduced rate of 10%

The 10% VAT tax rate is used in cases where sales are subject to strict certain product categories social orientation and only one type of service – air transportation throughout the country.

The Tax Code allows the use of a reduced VAT tax rate for sales transactions with the following products:

- food group of goods, excluding delicatessen products;

- subcategory of children's goods, except sports shoes;

- stationery for school purposes;

- periodicals, textbooks and scientific literature;

- goods related to medicine.

It is the question of eligibility for inclusion in a preferential group with a reduced VAT rate that raises the greatest number of questions among taxpayers and fiscal authorities.

How to check the legality of the 10% VAT rate

If a product is purchased for resale, then questions about the possibility of applying a reduced VAT rate, as a rule, do not arise. All products are supplied according to accompanying documents, including invoices, which indicate the applicable tax rate.

The situation is more complicated when an LLC or individual entrepreneur independently produces commercial products, which, according to formal criteria, are subject to preferential VAT taxation. In such situations, it is advisable to adhere to regulatory documentation - lists of product codes established by the relevant Government Decrees in the latest edition.

These registers indicate codes and names of product groups from the preferential tax list. The OKP code is selected in the All-Russian Classifier and is confirmed by a certificate or declaration of conformity.

You should know: If the manufacturer cannot find the product being sold in the list of codes, then it would be more reasonable to indicate the general VAT rate - 18%. Otherwise, there is a risk of additional tax assessment during an audit by the fiscal authorities.

When the tax office may refuse to apply a preferential VAT rate

When selling packages that contain groups of goods with different VAT rates, the use of a reduced percentage may lead to justified claims from the tax authority.

Example 1

To increase sales, trading organizations often use a sales scheme for self-assembled kits, where goods are subject to VAT at different rates. For example, on the eve of the New Year holidays, a huge number of children's gifts appear on sale, containing candy and toys. Confectionery products (sweets) are subject to VAT at the rate of 18%, and children's toys belong to a preferential group of goods.

The Ministry of Finance and the Federal Tax Service considers the use of a 10% VAT rate on a New Year's gift set when setting the price to be an illegal action, since the list of codes of the Government of the Russian Federation No. 597 dated June 18, 2012 does not contain such a position.

A similar situation may arise, for example, when selling specialized magazines with the provision of an additional service - access to a web resource or electronic media. In this case, the 10% rate applied to printed products can only be applied directly to the magazine. The service of virtual news publication should be taxed at the standard rate of 18%.

Keep in mind! To avoid tax claims when selling sets with different VAT percentages, it is advisable to indicate in the documents and on the price tag the individual product items included in the set.

Example 2

Sales of bakery products are carried out using a reduced VAT rate of 10%. When updating the product range, you should be careful about the names of new products. For example, the term "pizza" not in the list of OKP, therefore, despite actual compliance with the letter of the law, for formal reasons the manufacturer must apply a rate of 18% when selling pizza.

Conclusion: It is advisable to choose a name for a new product for which it is planned to apply a preferential VAT rate, being as close as possible to the terms used in regulatory documents - lists of OKP approved by the Government of the Russian Federation.

Simple names will not give tax authorities grounds to refuse to use the reduced tax rate.

How to correctly apply the estimated VAT rate

The use of the estimated VAT rate - 18%/118% or 10%/110% - is stipulated in Article 164, paragraph 4 of the Tax Code of the Russian Federation and is allowed in the following situations:

- when issuing an invoice for the received advance payment;

- when calculating VAT by a tax agent;

- when using an assignment agreement (assignment of monetary claims).

The calculation assumes that the amount of the advance received or the monetary claim accepted already includes the amount of tax, which should be calculated by simple arithmetic operations.

The most common option for isolating the VAT amount is to draw up an invoice for the advance received.

How not to overpay VAT on an advance payment

When issuing an invoice for prepayment received for the supply of goods taxed at different rates (10% and 18%), the tax department insists on applying the maximum rate - 18%/118%. However, an LLC or individual entrepreneur does not always know in advance the exact list of goods that will be shipped against the received advance payment.

Because of this, there is often an overpayment of VAT, the return of which is problematic.

The right to a deduction for the supply of goods at a rate of 10% will most often not be approved by the tax office, so it makes sense for the taxpayer to defend his truth in court in advance. It must be said that the Arbitration Courts, when considering such claims, side with the enterprise.

Important to know: When selling goods at different VAT rates, it is advisable to group goods with the same VAT rate in prepayment invoices (or specifications for the supply agreement).

Then the taxpayer can legally claim a tax deduction at the appropriate rate without resorting to court.

Incorrect application of the VAT rate is fraught for the taxpayer with additional tax assessment and the presentation of significant fines and penalties.

Since tax legislation is constantly changing, it is necessary to constantly monitor innovations regarding VAT.