Transport tax. Why is the transport tax not received for the vehicle? Why is the transport tax not sent?

Individuals pay property taxes on the basis of a tax notice sent to them by the tax authority.

The tax notice is sent no later than 30 days before the payment is due.

The tax notice must indicate the amount of tax to be paid, the object of taxation, the tax base, the deadline for paying the tax, as well as the information necessary to transfer the tax to the budget system of the Russian Federation. Tax notice form approved

A tax notice can be handed over to an individual (his representative) in person against signature on the basis of an application received from him for the issuance of a tax notice, including through the MFC (with which the tax authority has entered into an agreement on the possibility of providing the relevant service), sent by registered mail or transmitted through the taxpayer’s personal account.

If a tax notice is sent by registered mail, the tax notice is considered received after six days from the date of sending the registered letter.

For users of the taxpayer's Personal Account, a tax notice is posted in the taxpayer's Personal Account and is not duplicated by mail, except in cases where the user of the taxpayer's Personal Account receives a notification about the need to receive documents on paper. The form of such a notification was approved by order of the Federal Tax Service of Russia dated February 12, 2018 No. ММВ-7-17/87@.

Tax notices to owners of taxable objects are sent by tax authorities (posted in the taxpayer’s Personal Account) no later than 30 days before the tax payment deadline: no later than December 1 of the year following the expired tax period for which taxes are paid. If the specified deadline falls on a non-working day, it is transferred to the next working day.

However, tax notices are not sent in the following cases:

- the presence of a tax benefit, tax deduction, or other grounds established by law that completely exempt the owner of the taxable item from paying tax;

- if the total amount of taxes reflected in the tax notice is less than 100 rubles, with the exception of the case of sending a tax notice in a calendar year, after which the tax authority loses the opportunity to send a tax notice;

- the taxpayer is a user of the Internet service of the Federal Tax Service of Russia - the taxpayer’s personal account and has not sent a notification to the tax authority about the need to receive tax documents on paper.

In other cases, if a tax notice for the period of ownership of a taxable object has not been received by November 1 of the year following the expired tax period, the taxpayer must contact the tax office or send information through the taxpayer’s Personal Account or using the Internet service of the Federal Tax Service of Russia "".

Owners of taxable properties who have never received tax notices and have not claimed tax benefits in respect of a taxable property (report form approved).

Additional information can be obtained by calling the tax office, the contact center of the Federal Tax Service of Russia: 8 800-222-22-22 , as well as in the “” section.

Tax notice contains inaccuracies

Information about taxable property and its owner (including characteristics of the property, tax base, copyright holder, period of ownership) is submitted to the tax authorities by bodies carrying out registration (migration registration) of individuals at the place of residence (place of stay), registration of acts of civil status of individuals, bodies carrying out state cadastral registration and state registration of rights to real estate, bodies (organizations, officials) carrying out state registration of vehicles, guardianship and trusteeship bodies, bodies (institutions) authorized to perform notarial acts, and notaries, bodies carrying out issuance and replacement of identity documents of a citizen of the Russian Federation on the territory of the Russian Federation.

Responsibility for the accuracy, completeness and relevance of the specified information used for property taxation purposes lies with the above-mentioned registration authorities. These bodies provide information to the tax service based on information available in their information resources (registers, cadastres, registries, etc.).

If, in the opinion of the taxpayer, the tax notice contains outdated (incorrect) information about the property or its owner (including the period of ownership of the property, tax base, address), then in order to check and update it, you must contact the tax authorities using any in a convenient way:

- for users – through the taxpayer’s Personal Account;

- for other persons: by personal contact to any tax office, or by sending a postal message, or using the Internet service of the Federal Tax Service of Russia "".

As a general rule, the tax authority requires an audit to confirm the presence/absence of grounds established by law for recalculating taxes and changing the tax notice (sending a request to the registration authorities, checking information about the availability of a tax benefit, determining the start date of application of the current tax base, etc. .), processing the information received and making the necessary changes to information resources (databases, budget payment cards, etc.).

If there are grounds for recalculating the tax(s) and generating a new tax notice, the tax office no later than 30 days (in exceptional cases, this period can be extended by no more than 30 days):

- will recalculate the tax;

- If there are grounds, it will generate a new tax notice and post it in the taxpayer’s Personal Account. If you are not a user, will send a new tax notice in the prescribed manner;

- will send you a response to your request (will post it in), incl. if there is no basis for recalculating the tax(s).

Taxpayers - individuals (including individual entrepreneurs) pay all property taxes on the basis of a tax notice sent by the tax authority.

The tax is payable by individual taxpayers no later than December 1 of the year following the expired tax period. If the specified deadline falls on a non-working day, it is transferred to the next working day.

The taxpayer pays tax for no more than three tax periods preceding the calendar year of sending the tax notice.

Recalculation of amounts of previously calculated property taxes for individuals is carried out for no more than three tax periods preceding the calendar year of sending a tax notice in connection with this recalculation. At the same time, from January 1, 2019, recalculation of land tax and property tax for individuals is not carried out if it entails an increase in previously paid amounts of these taxes based on sent tax notices.

Payment of the tax may be made on behalf of the taxpayer by another person, however, this person subsequently has no right to demand a refund from the budget system of the Russian Federation of the tax paid on behalf of the taxpayer.

For the convenience of taxpayers, several methods of paying property taxes have been implemented:

- in the Internet service Taxpayer Personal Account;

- through the online service of one of the partner banks of the Federal Tax Service of Russia;

- through branches of banking and credit organizations;

- through the cash desks of local administrations or the federal postal service;

- from January 1, 2019 – in the MFC “My Documents” (subject to the decision of the highest official of the constituent entity of the Russian Federation on the possibility of accepting tax payments through the MFC).

Good afternoon, dear reader.

Every year, vehicle owners must pay transport tax for each vehicle they own. In most cases, taxes are calculated and paid without any problems. Nevertheless, overlaps sometimes occur.

For the purposes of this article, the following example will be considered:

Ivanov Ivan Ivanovich owns a car and an apartment. At the same time, he must pay property tax - 4,100 rubles and transport tax - 5,900 rubles. Total - 10,000 rubles.

At the same time, Ivan Ivanovich knows in advance what taxes he must pay, and if any mistake is made in his personal account, he will immediately notice it.

Let's consider 2 typical problems that a taxpayer may have:

1. The tax did not arrive in your personal account

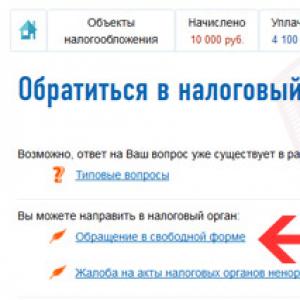

3. Go to the section:

Taxpayer documents – Contact the tax authority – Free form application

4. Fill out the application form:

a) Select the inspection you want to contact. All inspectorates to which you pay taxes must be listed. However, if the required division is not available, then you should select the “Other tax authority” item.

b) Write the text of the appeal:

Hello.

A receipt for payment of transport tax for 2016 for the Renault SR car I own, registration plate A123AA 777, has not yet appeared in my personal taxpayer account (11/31/2017).

Hello.

On November 3, 2017, I paid the transport tax (I am attaching a payment receipt), but the payment information has not yet been reflected in my personal account (November 31, 2017).

Please look into the situation and explain to me why this happened.

Transport tax in 2019: basic calculation rules

The amount of tax payment depends on the power of the vehicle, which is calculated in horsepower. In order to calculate the transport tax for 2019, you need to refer to regional legislation, since specific tax rates are set by the authorities of the constituent entities of the Russian Federation. For example, the transport tax in Moscow in 2019 for passenger cars with a capacity of 175-200 hp. With. determined at a rate of 50 rubles. for every horsepower. In addition, tax benefits may be provided at the regional level (for example, for pensioners, parents with many children, etc.).

According to the law, motorists do not have to calculate the amount of tax, because the responsibility to calculate the amount of payment for transport, as before, lies with the tax authority. But at the same time, the tax office is not immune from errors, so checking the correctness of the calculations made by it will not be superfluous. If the car is registered to a legal entity, then calculating the tax amount is the direct responsibility of the accountant of this organization.

Transport tax 2019: new rates for expensive cars

In our country, there have been discussions for several years about the need to introduce a so-called luxury tax. The first step in this direction has been taken: the provisions of the Tax Code of the Russian Federation on the increasing coefficient when calculating the tax on cars whose cost exceeds 3 million rubles have come into force.

We list the basic rules for applying the coefficient:

- It is used only for passenger cars.

- The size of the coefficient depends on the price of the car and its age.

- For cars whose price is from 3 to 5 million rubles, the tax is charged in an increased amount if 3 years have not passed since their manufacture (coefficients from 1.1 to 1.5 are used).

- With a coefficient of 2, the tax is calculated on cars not older than 5 years, the price of which is 5-10 million rubles.

- Tax is calculated with a coefficient of 3:

- For cars no older than 10 years worth 10-15 million rubles;

- Cars valued at more than 15 million rubles, if they are no more than 20 years old.

The procedure for determining the average price of a vehicle was approved by the Ministry of Industry and Trade of Russia (order No. 316 dated February 28, 2014). It is calculated using one of 2 developed formulas. The application of this or that formula depends on whether there are representative offices of the car manufacturer in our country - from them the ministry requests information on recommended prices for cars of specific brands and models.

An owner of an expensive car who wants to find out how much cars of this brand are valued at should visit the official website of the Ministry of Industry and Trade. Every year, no later than March 1, a list of cars whose cost exceeds 3 million rubles is published. The tax office uses the same data when calculating transport tax in 2019.

Transport tax 2019: new responsibilities of payers

As of January 1, 2015, transport tax payers have a new obligation. If the citizen to whom the vehicle is registered has not received a notification to pay the tax, he must independently inform the tax office about the presence of the car. However, as explained on the Federal Tax Service website, this will not need to be done in the following cases:

Don't know your rights?

- if a tax notice arrived at least once, and then stopped coming;

- if the notification was not received due to the provision of benefits to the owner of the vehicle.

The fulfillment of this duty includes the following:

- You can submit a report by mail, at a personal appointment at the inspectorate, as well as through the “Taxpayer Personal Account” service on the Federal Tax Service website.

- The message is drawn up in the prescribed form (form according to KND 1153006), it indicates which vehicles are registered to the citizen and from when.

- A copy of the vehicle registration certificate with the traffic police is attached to the message.

- The notification must be submitted no later than December 31 of the year following the year for which the tax is due.

- If a citizen has received a notification to pay tax not for all cars registered to him, he is obliged to inform the Federal Tax Service about vehicles not listed in the received notification.

- If the notification is not sent in connection with an existing tax benefit, then there is no need to submit a notification about the availability of a car.

- A report on each vehicle is submitted to the tax authority once.

Failure to fulfill this obligation is subject to a fine of 20% of the unpaid tax (this rule came into force on January 1, 2017).

How to print a receipt for payment of transport tax?

There are several ways to check your transport tax debt:

- to the Federal Tax Service at your place of residence;

- on the government services website in the taxpayer’s personal account;

- on the official website of FNM (nalog.ru).

Using these resources, you can print a receipt for payment of transport tax and pay the debt at any bank.

How to pay transport tax without a receipt?

If you don’t have a receipt issued by the Federal Tax Service, but transport tax needs to be paid, we can recommend several ways out of this situation:

- Go to the Federal Tax Service website and, through the service pages of the site, calculate the amount of tax and pay it there.

- Log in to the government services website and request the Federal Tax Service’s service to inform you about existing debts. Next, you need to follow the instructions of the system and pay the tax on the website.

Transport tax rates in 2019. What changes are planned?

The need to reform the transport tax has been discussed for several years. Some politicians and economists propose canceling the transport tax and increasing excise taxes on fuel to compensate for budget losses. However, in a letter dated 04/02/2013 No. BS-2-11/221@, the Federal Tax Service of Russia announced that the abolition of the tax on transport owners is not expected in the near future, since a serious increase in excise taxes will inevitably lead to an increase in prices for consumer goods.

At the same time, the Russian Ministry of Finance is currently busy developing new rules for calculating payments for transport. It is quite possible that in the near future these innovations will be adopted at the legislative level.

What is the essence of the new approach to calculating transport tax? The Ministry of Finance proposes to abandon the calculation of taxes depending on the horsepower of the vehicle. Instead, the amount payable to the budget will be determined based on engine size. In addition, coefficients will be introduced depending on the age of the car and its environmental class.

The option of replacing the so-called tax is also being discussed. environmental payment, which is applied in some European countries. If it is introduced, owners of old cars will have to pay much more than owners of new cars. According to the authorities, this approach will encourage motorists to purchase new, more environmentally friendly car models.

In conclusion, it is necessary to clarify once again that such proposals from the Ministry of Finance are still at the stage of discussion and preparation of a bill. Proposals to replace the transport tax with an increase in the excise tax on fuel are regularly submitted to the State Duma, but none of them has yet found approval.

It would seem that it is simply impossible for tax authorities not to send their tax payment notices to the country’s budget. But such situations do happen, and they happen for a number of reasons.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

And, nevertheless, law-abiding citizens who are car owners are most concerned about questions about who will be answerable to the law if the notification has not arrived and how a citizen should act when he has not received information about the amount of the mandatory tax payment for a long time. your own transport.

After all, a notification of such a payment is sent by mail in the form of a registered letter and issued to the car owner against signature.

Possible reasons

By law, every vehicle owner is required to pay transport tax no later than the deadlines specified by the new rules in the legislation.

It looks like this: you bought a car in May 2018, but in 2018, until October 1, you still did not receive any notice of payment of transport tax on the car you bought.

Your actions should be as follows - you submit information about your automobile ownership to the district tax service at your place of registration no later than December 31, 2018.

Moreover, it doesn’t even matter how many months you owned the car in 2018, if you have already sold it, you will still have to pay for the time you owned it.

If you always live by the rules and don’t like to break them, then you can also listen to the recommendations of experts about whether you have already managed to pay something, as well as how much you owe to the state budget.

To do this, you can go to your personal account on the nalog website and check your transport tax debts, if, of course, you were registered in the database as a taxpayer and a tax inspector gave you a password to access your personal account.

If not, then one way or another, you will have to go to the tax office for a password to authorize on the taxpayers’ website.

If you haven’t paid for a very long time, then, to make sure that you haven’t been sued, go to the FSSP website (Federal Bailiff Service), entering your personal data, you can see in the database whether there is information on you or not.

If the entry “nothing was found for your request” is displayed, then rest assured, they have not yet had time to sue you. However, this does not mean that you should immediately forget about the transport tax.

This just gives you some more grace period when you can still pay the tax.

In addition to the established deadlines for submitting information about the ownership of a car, it is useful for a citizen to know a simple algorithm of actions in case, suddenly, a notification from the Federal Tax Service (Federal Tax Service) never arrived in his mail.

The steps he should take as a law-abiding citizen are as follows:

- write a written message on the standard form according to KND 1153006, which you get from the tax service. In this message, you indicate that you are the owner of the car and indicate its parameters.

- in the second part of such a form you already indicate directly the details of your car and the fact that it is currently in your ownership:

- Attach to this message a copy of the registration certificate in your name with the traffic police of a specific vehicle.

- if you own several cars, then you should file a declaration for each car separately.

This type of message is sent only once. If after this you still do not receive notification of payment of the required amount of transport tax, then you will have every right not to do anything.

After all, you, for your part, as a law-abiding taxpayer, did not evade payment, and therefore further responsibility will already lie with the tax authorities.

But you still have to pay so that you are not burdened with any public debt. In addition to a written paper message, you are also given the opportunity to do the same thing, only on the Federal Tax Service website.

You fill out all the required fields of the form, and also attach copies of the document confirming your ownership.

Is it possible not to pay transport tax?

Previously, even before the changes in car registration on October 15, 2013, it was possible not to pay the transport tax if you did not receive a notification about payment of such a road tax in your mailbox on time.

Moreover, especially legislative acts would not even call you to take any steps in such a situation.

However, today, lack of notification is no longer a basis for non-payment of tax, and you will need to take a number of actions that are prescribed by the rules at the legislative level.

If you have done everything that was required of you, but the notification never arrived, then you independently go to your personal account on the Nalog website, print out a receipt and go pay to the bank.

Possible consequences of non-payment

When a taxpayer evades paying mandatory contributions to the budget, this always entails negative consequences. The same is true in the case of transport tax - failure to pay it is fraught with a fine of 20% of the total amount owed.

The percentage of the fine is taken only for the entire expired period of debt, and therefore if the statute of limitations has not yet passed - 3 years - you will be forced to pay the fine.

It can be taken from your salary through a statement of claim from the tax inspectorate, which will initiate a case against you, and the bailiffs will pester you in every possible way so that you pay the required amounts.

The established one suggests that, in principle, the tax services of car owners are not particularly in a hurry and give enough time to collect funds to contribute the road tax to the regional budget of the country.

Last updated April 2019

Almost all vehicle owners are faced with the concept of transport tax. But not everyone knows who must pay the tax, in what amount and within what time frame. We will help you understand the procedure for paying transport tax by individuals, the features of its calculation, as well as the specifics of debt collection and the statute of limitations for its collection.

What is transport tax and who pays it?

The basis for calculating tax is information received by the Federal Tax Service from the State Traffic Safety Inspectorate. Such data is received at the request of tax authorities, as well as at the initiative of the state traffic inspectorate in connection with the registration of a new car, a purchase and sale transaction, deregistration for disposal, etc.

If and until the car is registered with a citizen (according to the traffic police), the responsibility for paying tax will be with this citizen.

That is, if:

- the car is stolen, the tax office should be notified about this by presenting a document about contacting the police;

- if a car was sold, and the buyer for some reason does not re-register it in his name, the former owner remains the tax payer, and he is listed as the owner in the traffic police database;

- if a car is purchased on credit, tax accrual begins from the date of registration of the vehicle with the traffic police.

The car owner does not need to calculate anything. All calculations are made by the tax office and send the taxpayer a tax receipt at his registered address. Payment is made every year, for example:

- for 2016 until December 1, 2017

- for 2017 until December 1, 2018

- for 2018 until December 1, 2019, etc.

As a result, transport tax is considered to be a payment to the budget on the basis of a tax notice. This payment must be made to the owner of the vehicle: car, motorcycle, scooter, etc. The tax is mandatory. The payment procedure itself is prescribed in the tax law, and municipal authorities determine the amount of the tax rate, the increasing coefficient, as well as the conditions and amount of benefits for car owners.

Object and tax base

The object of taxation is vehicles, including land, water and aircraft (both self-propelled and trailers). Individuals often pay the fee for motorcycles, buses, cars, scooters, ATVs and other vehicles for personal use. But do not forget that the fee is also imposed on owners of boats, motor sleds, motor boats and jet skis.

The amount of payment to the budget depends on the tax base. And the size of the base is determined by the type of transport.

- If the product is equipped with an engine, then the basis for calculation is power (unit of measurement - horsepower).

- If the air or water vehicle does not have an engine (for example, a floating crane, landing stage), then the fee is related to the gross tonnage indicator (unit of measurement - register tons).

- In exceptional cases, the base is taken as a vehicle unit for calculation.

Payers

The person who pays the fee is the owner of the car (motorcycle, boat, etc.). Exactly the one to whom the vehicle is registered according to the registration records of the Ministry of Internal Affairs.

If the car is stolen

Is there an obligation to pay a fee in case of car theft? After all, only the documentary ownership of the car remains, and the owner cannot physically dispose of it. It is allowed not to make a payment when the theft of the car is documented. Such a document is issued either by the police or the investigative committee, which is directly involved in searching for the car and investigating the incident. Resolutions from these structures must be submitted to the Federal Tax Service so that the tax is not calculated from the date of theft.

If the car is being repaired or impounded, is in a garage and is not in use

There are reasons why a car is not used by the owner (the most common examples: the car was driven to an impound lot, the driver was deprived of his license, the vehicle is being preserved in a garage or undergoing long-term repairs). How to pay transport tax in this case? The logic is simple: since according to the documents you are still the owner of the car, then the obligation to pay for it remains unchanged. The fact that the car is idle does not matter in this case.

Beneficiaries

There are vehicle owners who are not required to pay the tax to the budget. So, you have every right not to pay the fee if you own:

- rowing boat;

- motor boat (power up to 5 horsepower);

- a special car for disabled people;

- tractor or combine.

If you have received a notification about the need to pay a fee for this vehicle, you have the right to ignore it. This document is erroneous or illegal.

Also, the state at the regional level provides benefits in the payment of fees by certain social strata of the population. As a rule, they exempt from payment (or reduce the rate):

- for pensioners (see);

- persons of pre-retirement age;

- members of large families;

- disabled people;

- veterans;

- as well as owners of low-power vehicles.

If the beneficiary owns two or three types of transport (for example, a car and a boat), then he will receive an exemption from paying the fee for only one of them.

How to determine the tax amount

To determine the amount of the fee that the vehicle owner is obliged to transfer to the budget, you will need to know the basic indicators. These are the engine power and the collection rate. Everything is simple with power - its value is indicated in the registration documents for the car. If the power of your car is indicated in kW, then you need to convert them to horsepower (l/s). To calculate, use the formula:

M l/s = M kW * 1.3596.

Tax rate

The rate indicator is determined depending on the type of transport (cars, buses, snowmobiles, snowmobiles, yachts, etc.) and engine power. Tax law determines the federal rate. For 2019 the picture looks like this:

And for motor vehicles:

These values are used in those regions/territories/republics where the rates are not specified at the regional level (but in all regions this has been taken care of). At the same time, local authorities have the right to adjust the rate. You can either increase or decrease the bet by no more than 10 times.

For example, the transport tax rate:

- for residents of the Leningrad region who own motorcycles up to 20 l/s, it is 10 rubles. for every horsepower.

- the same figure for residents of the Yaroslavl region is 7.5 rubles.

You may also need additional values to calculate the fee amount:

- if you registered ownership of the car less than a year ago, then when calculating you need to use the indicator of the number of months of ownership;

- If you own an expensive car, then you also need to use a multiplying factor when calculating.

Luxury cars

For premium cars, a multiplying factor is applied when calculating tax. It is established in a single standard for all regions of the Russian Federation. That is, local authorities can adjust the rate, but the coefficient for expensive cars cannot vary by region.

The coefficient has 3 meanings:

- minimum "1.1"- it covers cars costing from 3 to 5 million. rub. and year of manufacture of which no older than 3 years;

- middle "2"- cars costing from 5 to 10 million rub. no older than 5 years;

- maximum "3"- car cost 10-15 million rub. age up to 10 years, or the price is higher than 15 million and 20 years have not passed from the date of manufacture.

Two more clarifications:

- the cost of cars is determined by the Ministry of Industry and Trade and is officially published on the Internet;

- If the car is older than a given age, then the tax goes to normal calculation.

Calculation formula and examples

Having all the above indicators, you can proceed directly to the procedure for calculating transport tax. To do this you need to use the following formula:

- where N is the amount of transfer to the budget;

- StN – tax rate;

- NB – engine power in (horsepower);

- KolMV – time that you own the car (in months).

If you own an expensive car (the criteria for inclusion in this group are described above), then the resulting result (H) must be multiplied by the increasing factor applicable to the category:

where PC is the coefficient for luxury cars.

In order to understand the peculiarities of calculating the fee, we use illustrative examples.

Example 1

In March 2018, Moscow resident S.D. Skuratov. acquired a Daewoo Lanos, which he sold in August 2018. In September 2018, Skuratov bought a Chevrolet Niva. The power of the first car is 70 l/s, the second is 80 l/s.

What amount is Skuratov obliged to transfer to the budget at the end of 2018? In order to determine this, we calculate the number of months during which Skuratov was the owner of each of the cars. Daewoo Lanos ownership 6 months. (from April to August inclusive), Chevrolet Niva - 4 months. (from September to December inclusive). The rate in both cases is 10 rubles. for every horsepower.

The fee calculation will look like this:

- For Daewoo Lanos you need to pay: H = 10 * 70 * 6/12 = 350 rubles.

- The fee for a Chevrolet Niva will be: N = 10 * 80 * 4/12 = 267 rubles.

- Total you need to transfer: 267 + 350 = 617 rubles.

But since Skuratov is a resident of Moscow, a 100% discount is applicable to him for cars with a capacity of up to 70 l/s. Therefore, Skuratov will transfer only 267 rubles to the local budget.

Example 2

In April 2018, Tula resident Markov S.G. bought a Mercedes G-350. The price of the car under the purchase and sale agreement was 6,830,000 rubles. The car was produced in 2017. Engine power – 224 l/s. For an expensive car, Markov will pay: H = 75 * 224 * 9/12 * 2 = 25,200 rubles.

In the Tula region, for a car with a given power (224 l/s), a rate of 75 is applied. Thanks to the increasing coefficient, the total amount was doubled.

Example 3

Resident of Belgorod, pensioner Ignatov K.S. purchased a Ural motorcycle in July 2018. At that time, Ignatov already owned a VAZ Largus car. The power of a motorcycle is 40 l/s, and that of a car is 105 l/s. Let's calculate the fee in each case:

- For a motorcycle, Ignatov must pay: H = 12.5 * 40 * 6/12 = 250 rubles.

- Ignatov must pay for the car: N = 25 * 109 = 2.725 rubles.

- The total amount to be transferred to the budget is 250 + 2.725 = 2.975 rubles.

Ignatov is a pensioner, which means he has the right to receive benefits regarding a motorcycle. It does not apply to the car, since there is a limitation in the form of vehicle power (up to 70 l/s). Thus, Ignatov will pay 2,975 rubles. (for VAZ Largus).

Calculation of transport tax for less than a month of ownership

Previously ( before 01/01/2016), it was considered that the month of registration of a vehicle, or the month of its deregistration, were taken as a full month. Those. part of a month was equal to a full month for tax calculation both upon registration and upon withdrawal.

Now, from 01/01/2016, the rules for calculating the amount of tax when registering and deregistering a vehicle during the tax period have changed. The amendments are as follows:

- The car is registered:

- until the 15th – transport tax for the full month;

- after the 15th day the month is not taken into account;

- The car is deregistered:

- until the 15th - the month is not taken into account;

- after the 15th - transport tax for the full month.

How to pay tax: procedure and deadlines

The reporting period for payment of transport tax for individuals is the calendar year, that is, in 2019 you make payments for 2018.

You must pay the fee no later than December 1. The basis for payment is the notification that you receive from the Federal Tax Service.

The Fiscal Service must send a notification no later than 30 days before the payment is due (before 11/01/2019 for 2018).

The notification is of a single form and includes amounts for transport, land and property taxes. If, for example, you own a plot of land from which you need to pay a land tax, then you will receive a single notification from the Federal Tax Service, which will indicate the total amount of obligations to the budget, including for the car and for the land.

The tax is calculated based on the data received about your car from the traffic police. The funds will need to be transferred for the period in which the car was registered in your name as the owner.

You can receive a notification in one of the following ways:

- By mail - in this case you will receive a registered letter with a stamp indicating the date of dispatch. If you missed the deadline for paying the fee due to late receipt of the notification, the date on the stamp will serve as proof that you were right.

- In person - a fiscal service employee will personally deliver the notification to you, and you, in turn, will sign to confirm receipt.

- By email- in order to receive a document in this way, you need to register on the Federal Tax Service website, after which you can independently receive a notification and a receipt for payment using an electronic resource (“Personal Account”). Using this method, you also have the opportunity to find out the transport tax of an individual by TIN.

Along with the notification, you will be sent a receipt for payment of the fee, on the basis of which you can transfer funds at any bank branch or to Sberbank online using the document number or TIN.

When paying transport tax for individuals in 2019, the following budget classification codes (BCC) are used in the payment order (receipt):

- KBK 182 1 06 04012 02 1000 110 - all main payments of individuals are carried out indicating this code; arrears, recalculations and other debts are repaid using the same code;

- KBK 182 1 06 04012 02 2100 110 - for payment of penalties due to delay in the main payment

- KBK 182 1 06 04012 02 3000 110 - fines;

- KBK 182 1 06 04012 02 4000 110 - this code is used for other income.

After transferring the payment, keep the receipt (copy of the payment order). It will serve as confirmation of the completeness and timeliness of repayment of obligations to the budget.

Often citizens, for one reason or another, do not repay their debts on time. In this case, the violator will be sent a demand for payment no later than 30 days from the moment the fiscal authority discovered the fact of non-payment.

If you are late in payment (or have transferred an incomplete amount), you are obligated not only to repay the amount owed, but also to pay penalties and fines accrued in connection with your violations. To calculate penalties, use the following formula:

- Where P is the amount of the penalty;

- N – amount of arrears;

- StRef – the Central Bank refinancing rate valid during the period of delay;

- KolDn – period of delay (days).

Example 4

The owner of the motorcycle is V.K. Serpov. On August 12, 2019, I received a tax payment notice in the amount of 4,740. Serpov violated the deadlines for paying transport tax and did not make the payment by December 1, 2019. Having received the request, Serpov transferred the funds on December 27, 2019. Due to violation of payment deadlines, Serpov was charged a penalty:

P = 4.740 * 11%/300 * 27 days. = 47 rub.

In addition to penalties, the state has the right to withhold a fine from the violator in the amount of 20% of the amount of outstanding obligations. A fine is charged both in case of underpayment and in case of complete non-payment of the amount.

Example 5

Sviridenko R.O. received a notification from the Federal Tax Service in the amount of 7,630 for 2018. On November 3, 2019, Sviridenko transferred the amount of 5,610. Thus, Sviridenko incurred a transport tax debt in the amount of 2.020 (7.630 – 5.610). In connection with the underpayment, a fine will be withheld from Sviridenko, calculated as follows:

W = (7.630 – 5.610) * 20% = 404 rub.

Debt and limitation period for its collection

It happens that car owners receive notifications about the repayment of tax debt for past years. A relevant question arises about the limitation period for transport tax, within which the Federal Tax Service has the right to collect uncollected payments. Debt collection is carried out in compliance with the following principles:

- There is no statute of limitations for paying off tax arrears. If you receive a notice (demand) within the prescribed period, the Federal Tax Service has the right to demand that you repay the debt for an unlimited amount of time.

- The period for calculating amounts to be paid is limited to 3 years. This fact suggests that if you do not receive notifications (demands), the fiscal authority has the right to calculate the amount and issue it to you for repayment for no more than 3 previous years (calculation in 2019 is allowed for 2018, 2017, 2016 and no earlier) .

- The period for collecting funds from the fiscal service is limited to 3 years. There may be situations when you are charged with an incorrect and excessive amount of the obligation to pay the fee (including fines, penalties), these obligations are repaid by you. But the fact of violations on the part of the Federal Tax Service has been established. In this case, you have the right to contact the Federal Tax Service with a request to return the funds, but no more than for the previous 3 years.

If the above conditions are violated, demands for debt repayment are considered illegal and therefore do not require satisfaction.

Question answer

Question:

Do I need to pay tax if my car is stolen?

On March 1, 2017, a 200 hp car was stolen from its owner, which is documented. At the end of the year, the owner received a notification from the Federal Tax Service about payment of tax in full at a tax rate of 75 rubles. per l/s: N = 200 * 75 = 15,000 rub. Are the actions of the Federal Tax Service legal in this case?

Answer: No, the Federal Tax Service compiled an incorrect calculation, since when calculating the fee, it is based on the actual use of the car (number of months). The correct calculation looks like this: H = 200 * 75 * 2/12 months. = 2,500 rub. To resolve the situation, you should contact the fiscal service authorities with a corresponding statement, as well as a copy of confirmation of the fact of theft. Similar situations may arise in various cases (including due to incorrect data provided by the traffic police). Having supporting documents in hand, you can easily prove that you are right and achieve a recalculation in your favor.

Question:

From what month does tax accrual on the sale of a car stop?

In April 2018, the owner sold the car, but deregistered it only on November 1, 2018. The tax office assessed taxes until November 2018. Why? The owner received a notification from the fiscal service, the amount of which is calculated as follows: H = 180 (power) * 42 (rate) * 10 (term of actual use in months)/12 months. = 6,300 rub. Since the purchase and sale agreement recorded the transfer of the car on 04/01/2014, the former owner contacted the Federal Tax Service with a request to recalculate the amount: N = 180 * 42 * 3/12 months. = 1.890 rub. The request of the person who sold the car was not satisfied.

Answer: The refusal of the Federal Tax Service is legally justified: the tax payer is the actual owner of the car according to the traffic police records. Since after the sale, the person who sold the car did not register the car in a timely manner, until November 1, 2018, the obligation to pay the fee rests with him.

Question:

When is tax charged if a car is purchased on credit?

On April 21, 2019, the car was purchased on the basis of a car loan agreement and registered on April 30, 2019. According to the loan agreement, ownership of the car passes to the new owner only after the final repayment of the entire borrowed amount. At what point must the fee be paid: from the date of the last loan payment or from the date of registration with the traffic police?

Answer: You are considered a payer of the fee from the moment you enter your account in the traffic police register. The terms of the loan agreement in this case do not matter. The same applies to cars that are under arrest and used in a criminal case as material evidence. The main criterion in this case is the fact of deregistration with the traffic police. If the car is registered, then you need to transfer the fee to the budget.

- Clause 1 of Article 360 of the Tax Code of the Russian Federation. Taxable period. Reporting period

- Clause 2 of Article 362 of the Tax Code of the Russian Federation. The procedure for calculating the amount of tax and the amount of advance tax payments

- Information from the Ministry of Industry and Trade of Russia "List of passenger cars with an average cost of 3 million rubles, subject to application in the next tax period (2018)"

If you have questions about the topic of the article, please do not hesitate to ask them in the comments. We will definitely answer all your questions within a few days. However, carefully read all the questions and answers to the article; if there is a detailed answer to such a question, then your question will not be published.

80 comments