Tax refund when purchasing real estate: calculation of the amount of payments and methods of receipt. How to calculate a tax deduction: useful information How to calculate a tax deduction for the purchase of an apartment

Tax deductions reduce the total amount of income from which any Russian taxpayer pays 13%. In essence, the deduction is the payment of wages in full over a certain period of time without deductions to the state treasury. In some cases, it is provided in the form of regularly refunded tax amounts (non-withholding of personal income tax from wages). Any applicant can calculate the tax deduction independently.

General principles of calculation

The amount of the deduction reduces the tax base or the amount of income from which tax was withheld. When calculating, use the following rules:

- The amount of the refund cannot exceed 13% of the taxes paid by the citizen.

- Only the person who officially pays these taxes to the budget can receive a deduction - through a tax agent from wages, by declaring income from the provision of services, receiving copyright profits, interest on securities, patents, etc.

- The deduction itself can be provided to both the citizen and some members of his family. For example, when returning tax on treatment or education, the right to use the benefit extends to the taxpayer’s children, his brothers and sisters, spouse and more distant relatives.

- When calculating the amount of the refund, only that income is taken into account, which, according to the law, is taxed at a rate of 13%. That is, individual entrepreneurs whose income is subject to a 6 percent tax (“simplified tax”) are not entitled to receive the benefit. This norm also applies to those entrepreneurs and citizens whose income is taxed at other rates: 9.35% (non-residents, gambling business).

Calculation of property deduction

The maximum amount depends on the total amount of tax the citizen transferred to the budget during the past year. The legislation defines the following limits:

- the maximum amount of income to which the benefit applies is 2 million rubles;

- at the same time, it cannot exceed 13% of the cost of living space;

- No tax is withheld from wages until the full amount due has been returned.

For example, if the applicant’s annual income is 360,000 rubles, the amount of personal income tax for the entire period is 46.8 thousand rubles. This citizen has the right to expect a return of 260 thousand rubles. If he receives a stable “white” salary, it will take him 5 years, 7 months to receive all the money due to him.

Since the beginning of last year, it has been allowed to use the deduction once in a lifetime, but before repaying the maximum amount. In other words, if a citizen received a deduction of 200,000 rubles when purchasing a home, when completing the next real estate transaction, he can claim a refund of another 60,000 rubles. Before calculating the amount of property tax deduction when purchasing an apartment or house, the applicant must register ownership of the property.

Calculation of professional deduction

The following may qualify for this type of refund:

- entrepreneurs in some cases;

- authors, inventors;

- private entrepreneurs;

- citizens who received income from performing one-time services.

The amount of professional tax deduction for personal income tax is equal to the amount of expenses confirmed by documents, but not more than 20% of profit. For example, an entrepreneur spent 50,000 rubles in the course of business. At the end of the year, he made a profit of 200,000 rubles. Exactly for 50 thousand rubles you distribute

If the applicant does not have such confirmation, the maximum possible deduction is applied to him - 20%. That is, in the above example, the amount of 200,000 rubles is multiplied by 20%. The amount of the deduction will be equal to 40,000 rubles - this is an unconfirmed deduction.

A deduction is also provided when declaring income from one-time work. It applies to expenses incurred by the applicant in the process of performing this work. If the legality of the expenditure is confirmed by documents, a full tax refund is due. If not confirmed - only 20% of the profit. This deduction is provided by both the Federal Tax Service and the tax agent-employer.

This type of deduction is very common and in demand. Before calculating the tax deduction for a child, you should decide on its size. The amount is fixed and the greater the number of children in the family. In 2015, the refund amount is:

- first child - 1.4 thousand rubles;

- second child - 1.4 thousand rubles;

- for a third or disabled child, 3 thousand are entitled.

Example: if a taxpayer has one child, his salary for the year is 200,000 rubles, then 1,400 rubles are deducted from this amount. Personal income tax is deducted from the amount of 18,600 rubles. Savings per month are equal to 182 rubles.

The payer is entitled to such a benefit until the child becomes an adult or completes full-time education. The benefit may cease to exist even earlier, when the parent’s salary reaches the limit of 280,000 rubles.

Both parents have the right to the benefit if they are officially employed and pay personal income tax. In addition, the law classifies adoptive parents and guardians as representatives of the child. If one of the parents refuses in writing in favor of the other parent to receive benefits, the latter will receive a double refund. This consent will not be required if the parent is considered single or the other parent has died or been reported missing.

Hello, friends!

Have you improved your living conditions or bought a plot of land? Did you know that you can get a tax refund from the state when buying an apartment with a mortgage or cash? A refund of part of the interest paid is also available. Maximum up to 650 thousand rubles. real money to your current account (260 thousand from the cost of housing and 390 thousand from mortgage interest). Such attractive figures cannot be ignored. Let's consider what needs to be done for this.

Property deduction is a reduction in the tax base for calculating income tax by the amounts that the taxpayer spent on the purchase of housing, land under a house or a plot intended for its construction.

A person who lives in the Russian Federation for more than six months, officially works and pays income tax (NDFL) is called a resident. Any resident can count on a tax deduction if he spent his own or borrowed funds to improve his living conditions, in the amount of 13 percent of the actual costs of purchase, construction and even finishing work.

Let's look at an example of a calculation. You bought a one-room apartment worth 1.5 million rubles. Part of the amount of 500 thousand rubles. you paid with your own funds, and took out a mortgage loan from the bank for the remaining amount. You can return 13% of 1.5 million rubles from the state: 1,500,000 x 13% = 195,000 rubles.

In addition, you can also receive 13% on the amount of interest paid to the bank. We have already discussed in detail how to return mortgage interest in our previous review. The link to it will be below.

What conditions for a return must be met:

- The amount of actual expenses does not exceed 2 million rubles. For example, from an apartment worth 2.5 million rubles. the refund will be: 2,000,000 x 13% = 260,000 rubles.

- Previously, the borrower did not receive a property deduction.

If you have already used the right to return once, but have not reached the maximum amount (for example, you bought an apartment for 1.5 million rubles), then you still have the opportunity to add 13% to yourself with another 500 thousand rubles on your next purchase.

- When purchasing housing and land, the right to deduction occurs after state registration of the property; in case of shared construction, the basis is a transfer deed.

- The annual property deduction cannot exceed the amount of income tax paid by the employee or his employer.

For example, you receive a salary of 40 thousand rubles. For the year, your income will be 480 thousand rubles. Your employer will pay 13% on it: 480,000 x 13% = 62,400 rubles.

You bought an apartment for 2 million rubles. and you have the right to deduct: 2,000,000 x 13% = 260,000 rubles.

You won’t be able to do this in one year because you paid significantly less taxes to the state. If you imagine that your salary will not change in the coming years, then you will be able to receive the full amount of money in 5 years.

Obviously, with a higher salary, it will be possible to return the amount due much faster. According to the previous example, if your salary is 60 thousand rubles, then in 3 years you will receive everything you are entitled to.

- You built or purchased a finished home with your own money or with a mortgage loan. The following are not taken into account: maternity capital, government subsidies to various categories of citizens, funds from the employer and any other third parties.

For example, you found an apartment for 1.8 million rubles and decided to take out a mortgage. RUB 453,026 At the expense of maternity capital, you made a down payment and added another 300 thousand rubles. own money.

The loan amounted to: 1,800,000 – 453,026 = 1,346,974 rubles.

Reimbursement from the amount: 1,346,974 x 13% = 175,106.62 rubles.

The same applies to military mortgages. The serviceman will only be able to reimburse the funds spent on the purchase of housing, if any. Amounts contributed by the state are non-refundable.

- The transaction for the purchase and sale of housing was not concluded between dependent people. The Tax Code includes parents, brothers, sisters, spouses, children, employers and subordinates as such.

- The loan agreement must clearly state the purpose of the loan - the acquisition or construction of housing, land for building a house. There are consumer loans that are issued against real estate. They are also called, but can be used for any purpose. That's what the contract will say. Therefore, the state will not accept these amounts for reimbursement.

Who has the right to return tax

Both citizens of the Russian Federation and foreigners can exercise their right to an income tax refund when purchasing housing with a mortgage. The main condition is their official employment and annual payment of tax to the state on all income.

The following have the right to deduction:

- Officially employed residents of the Russian Federation with a white salary.

- Pensioners. In this case, their official income, which was during the last 3 years before retirement, is taken into account.

- Parents, including adoptive parents, guardians and trustees, if they register the purchased real estate as the property of their children or wards.

- Co-borrower. This may be one or several people. Some banks allow up to 4 co-borrowers to participate. The spouse is required to be a co-borrower.

What can be included in actual reimbursement costs?

The standard basis for calculating the return is the amount of own or borrowed funds spent on the purchase of an apartment, room, residential building, land plot underneath, land plot for construction, as well as shares in all listed objects.

Please note that the property must be located in Russia.

The state allows expenses for repairs and additions to be included in the base. And here it is better to consider what applies to them separately for the construction of a house and apartment in a new building.

The actual costs of building a house include:

- project development and budgeting;

- costs of materials for construction and finishing;

- completion of an unfinished construction project;

- connection to utilities, creation of alternative energy sources.

In the actual costs of purchasing an apartment or room in a new building, you can include:

- costs of finishing materials,

- payment for the services of construction teams for finishing,

- development of a finishing project and drawing up a work estimate.

Please note that the contract must stipulate that you are purchasing an unfinished property. Only in this case will the costs of finishing and completion be reimbursed.

Step-by-step instructions for obtaining a property deduction

How to get back the money you spent on buying or building a home? Firstly, not all the money, but only part of it. Secondly, this can be done:

- through the tax office;

- through your employer, who actually transfers income tax to the budget for you.

How are these methods different? Because in the first case you will receive the compensation amount once a year. In the second case, you will receive it monthly. I give step-by-step instructions on the income tax refund procedure for both methods.

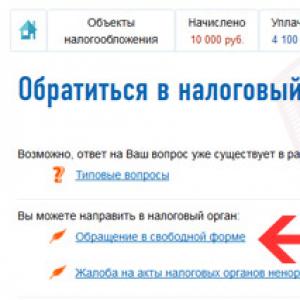

Through the tax authority

Step 1. Drawing up an income statement. It is often called Form 3-NDFL and is submitted to the tax office. This can be done at any time during the year following the reporting period. For example, you bought an apartment on August 20, 2018, starting in 2019, select free time and fill out documents for deduction.

How to fill out 3-NDFL? On the Federal Tax Service website in the “Software” section at the bottom of the site there is a “Declaration” program. Download and install it on your computer. It checks the correctness of the data you entered and generates an electronic document, which can then be sent to the tax office.

Some people are more accustomed to filling out documents manually. In this case, it is best to do this directly at the tax office, where they will always tell you how to do it correctly.

Most of my friends fill out the declaration online. I prefer to do this in inspection. There are samples there that I focus on. The main thing is not to try to get to the tax authorities before May of this year. You may find yourself in a crowd of entrepreneurs, notaries and other taxpayers who want to submit their income tax returns. Let me remind you that documents for property deduction are accepted throughout the year.

Step 2. Formation of a set of documents. I already gave a list of necessary documents when I discussed the topic. We won't repeat ourselves.

Step 3. Submission of documents to the tax authority. There you will also need to write an application for a refund, as well as separately indicate the bank account number where the refunded amounts will be transferred.

Step 4. Replenish your current account in approximately 3 - 4 months with the amount of the deduction.

If in one year you were not able to recoup your 13% from the purchase of an apartment, house or land, then you will do it in several years. You will have to undergo the above procedure the next year and so on until full compensation.

Through the employer

- Receiving a special notification from the tax office after submitting a set of documents.

- Submitting an application to the employer.

- Monthly receipt of salary, increased by the amount of income tax. This increase is the amount of property deduction for the purchase of housing.

Answers to the most popular questions

- How many times can I submit documents for deduction?

Until you reach the limit imposed by the state for reimbursement.

- Is it possible to get a refund if you bought an apartment several years ago?

Yes, you can. There is no statute of limitations.

- When can money be returned to temporarily unemployed citizens?

Indeed, there are situations when the borrower finds himself without work. For example, a woman went on maternity leave, the borrower was laid off or quit. It's OK. The reimbursement procedure is temporarily suspended until the taxpayer returns to official work. And it doesn’t matter that this will happen in a couple of years.

- Are other income taken into account when applying for a tax deduction?

Yes, sure. In this case, you indicate in your declaration all sources of income. Please note that they must be official. If, for example, you are renting an apartment, then confirmation will be a formal agreement with the tenant and documents confirming the transfer of rental funds to them.

Conclusion

I am sure that not all citizens who have bought an apartment or house know about their right to receive back part of the funds spent on it from the state. If 650 thousand rubles. a trifle for you, then you can ignore the article and not bother collecting documents. But for the majority, I think the amount is impressive.

Registration of deductions does not require special legal knowledge. You just need to set aside time to study the material. Once you get reimbursed the first time, the second year will be much easier. And waiting for your account to be replenished will be a nice addition. In future articles I will talk about insurance and whether you can get mortgage insurance back. Subscribe to our blog to constantly improve your financial literacy and not be deceived by banks, insurers and the state.

When purchasing a home, you need to determine the amount of expenses spent on the purchase. If you bought a house that has already been built and is completely ready for living, then you will receive a deduction from the purchase price.

If the house is not completed, then you cannot receive a deduction - since your purchase is an object of unfinished capital construction. But in this case, the expenses that you will incur when completing the construction of the house, connecting it to the electricity, gas, water supply, and sewerage networks can be deducted - after you receive a certificate of ownership of the house.

If the house is sold without finishing, and this fact is recorded in the purchase and sale agreement, then you have the right to deduct not only the costs of purchasing the house, but also the costs of construction and finishing materials, as well as payment for the work of builders and crews. But keep in mind that the purchase of furniture, plumbing fixtures and household appliances does not fall under the rules for obtaining a property tax deduction (clause 2, clause 1, article 220 of the Tax Code of the Russian Federation).

Citizens can receive a tax deduction when purchasing a house with a plot, provided that the house is a permanent building on the plot. If you simply buy a plot of land for individual construction, then you will not be given a deduction. But after you build a house on the purchased plot, feel free to collect all payment documents confirming your construction expenses, register ownership of the building and go to the Federal Tax Service for a tax deduction.

The amount of the tax deduction is equal to your costs for the purchase, completion or construction of housing from scratch, but within the limit of 2 million rubles. Since the tax deduction directly depends on the amount of income tax that the employer transfers from your salary, the state will return no more to you than you paid to the budget for the year. The remainder of the deduction is carried over to the next year - and so on until the taxpayer receives the full amount of money due to him. Let us explain using an example of calculating tax deductions.

Evgeniy Borisovich Timashkov bought a plot of land with an unfinished dacha on it in 2015 for 1 million rubles. Timashkov spent 253 thousand rubles on supplying water, gas, and electricity; Evgeniy Borisovich spent another 1 million rubles on completing the construction of the dacha: he built on the second floor, and did the “finishing” of the dacha. In March 2016, Timashkov received a certificate of state registration of ownership of the house. Timashkov’s total housing costs amounted to 2 million 253 thousand rubles.

Evgeniy Borisovich has never received a property tax deduction until this moment, which means he has the right to a deduction in the maximum amount - 2 million rubles. That is, the state will return 260 thousand rubles to Timashkov. Timashkov’s salary is 50 thousand rubles. In a year, Evgeniy Borisovich earned 50 thousand * 12 months = 600 thousand rubles. Since Timashkov does not have standard tax deductions, personal income tax for the year is 78 thousand rubles (600 thousand * 13%). Evgeniy Borisovich can return income tax to the Federal Tax Service from the next calendar year after receiving ownership of the house.

It turns out that in 2017, tax officials will return 78 thousand rubles out of 260 thousand rubles to Timashkov. The balance of the deduction – 182 thousand rubles – is transferred to 2018. If Evgeny Borisovich’s salary remains unchanged, then he will receive his full money only in 2020 (78 thousand rubles in 2017, 2018, 2019 and 26 thousand rubles in 2020).

There is another way to receive an income tax refund from the state - to receive a notification from the Federal Tax Service, according to which the employer ceases to withhold income tax from the employee. The advantage of this method is that you can apply immediately after receiving ownership of your home; you do not have to wait until the end of the calendar year.

The employer will no longer withhold tax from the beginning of the calendar year in which the notice was received. If this happened in the middle of the year, then personal income tax for the previous months is considered excessively withheld and must be returned to the employee - this is indicated by the Review of the practice of applying Chapter 23 of the Tax Code of the Russian Federation by courts dated October 21, 2015. Let's return to our example.

Since Timashkov received documents for the house in March 2016, he can submit a tax notice to the employer and begin receiving an income tax refund in 2016. Evgeniy Borisovich brought the notice to the accounting department in May 2016 - starting from May, the employer will not withhold personal income tax from the employee’s salary - that is, Timashkov will now receive “in hand” not 43,500 rubles (50 thousand - 13%), but 50 thousand rubles. And the tax withheld from January to April will be returned to Timashkov. For 2016, Timashkov will receive an income tax refund from his employer in the amount of 78 thousand rubles.

For 2017, Timashkov will have to take a new notice - since it is given only for one calendar year. Timashkov will finish receiving a property tax deduction from his employer a year earlier than if he received it from the inspectorate - since the money began to be returned to Evgeniy Borisovich not in 2017, but in 2016.

Attention! If a taxpayer works in several companies, then he can receive a deduction for each place of work. The main thing is that for each organization he receives a separate notification from the Federal Tax Service.

If you bought an apartment, say, in 2013, but learned about the property deduction only in 2016, then you can return income tax for the last three calendar years (but not earlier than the year you purchased the property). That is, for the calculation, income for 2015, 2014, 2013 will be taken into account. We remind you that for pensioners it is allowed to return income tax from three calendar years before the year of purchase of housing.

Please note that to calculate the amount of income tax refundable from the budget for each calendar year, the official salary of the employee is taken. Often, an employer, by agreement with a subordinate, pays the latter wages for work in the minimum amount established by the state. And the rest is given to the employee “in an envelope.”

By agreeing to a “gray” salary, you not only reduce your future pension, but also extend the period of time during which the state will fully reimburse you for the right to a property or social deduction. If Evgeny Borisovich Timashkov from our example had a salary of not 50 thousand, but 10 thousand rubles, then he would receive a property deduction when buying a home not after more than 3 years, but after 16 years! Imagine how much this money will depreciate after so many years!

If you bought an apartment in advance, then you have the right to a tax deduction by law. This applies to first time purchases, i.e. if you take out a mortgage again and have already received a subsidy from the state, then you lose the right to it.

The tax deduction consists of a deduction from the amount of the mortgage loan and interest plus a deduction from the interest paid on the loan to the bank.

You can receive the deduction immediately or from your salary for each month.

Tax deduction for mortgage interest. Calculation of property tax deduction.

For example, let’s take a mortgage loan for 2.5 million rubles for 10 years. The mortgage rate is 12.5%. For example, Sberbank provides such loans.

To calculate the deduction amount, you need to know the loan amount and the amount of interest paid on the loan.

Loan amount = 2.5 million rubles. By law, you have the right to receive a maximum of 13 percent on an amount of 2 million rubles. Those. a subsidy from an amount of 2.5 million rubles or more will be equal to a deduction from an amount of 2 million rubles.

Deduction from the loan amount = Rate * Loan amount (if the amount is less than 2 million)(1)

Deduction from the loan amount = Rate * 2 million (if the amount is more than 2 million) (2)

In our case, the rate is 13 percent. Let's substitute the data into the formula and the following data:

Deduction from the loan amount = 0.13 * 2,000,000 = 260 thousand rubles.

You can receive an amount of 260,000 rubles, provided that 13 percent of your total salary for the year exceeds this amount.

Mortgage interest deduction

To calculate loan interest, you can use.

The total amount of interest for the entire period will be 1890985.89 rubles.

Tax deduction on mortgage interest - let's calculate the amount of interest deduction:

interest deduction amount = 0.13 * 1890985.89 = 245828.1657

But this subsidy can be received in full when you pay the interest. This is a subsidy on the amount of interest for the entire loan term. You can get it at the end.

However, you can receive a tax subsidy when buying an apartment every time you work.

Here is an example of calculating a deduction with a total using .

As you can see, for the first year the deduction from the purchase and the deduction from interest will be 39656.46.

It should be noted that with early repayment, the amount of tax subsidy on interest is reduced, since the interest on the loan decreases.

Then, each year, the right to deduction increases in proportion to the amount of interest paid. The figure shows the deduction amount with a cumulative total - see resp. column.

The deduction balance column at the end of the year shows the difference - Deduction balance at the end of the year - the total income tax on wages for the year.

As you can see, a salary of 25 thousand for 10 years is not enough to get a full tax deduction.

RUB 505,828 > RUB 390,000

Even in the end, in theory, the state will owe you.

If the total income tax on your salary is in a year, then the remainder of the deduction is carried over to the next year.

In the case of shared construction, the subsidy is calculated based on the share of ownership of each of the construction participants.

Sample application for tax deduction

You can download a sample application for a tax deduction at work at.

To receive a tax subsidy from your salary, you need to provide a number of documents:

- A copy of the loan agreement

- Application for tax deduction (taken from the tax office)

- A certificate from the bank about interest paid for the previous year (if any)

- 2NDFL certificate from work

- Purchase and sale agreement - or equity participation (copy)

All this data must be sent to the taxpayer relations department in the region where your property is located.

In this section we will provide examples of calculating property tax deductions in different situations.

NOTE:

- A tax deduction is the amount by which the tax base is reduced. At the same time, you can get back 13% of the tax deduction amount.

- Due to the fact that from January 1, 2014, a number of changes were made to the Tax Code, in some cases the features of obtaining a deduction differ depending on whether the housing was purchased before January 1, 2014 or after. For such cases, two separate examples are presented.

Example 1: Buying an apartment

In 2018, Ivanov A.A. I bought an apartment for 2 million rubles.

In 2018, Ivanov A.A. earned 50 thousand rubles a month and paid a total of 78 thousand rubles. income tax for the year.

Calculation of deduction:

In this case, the amount of property deduction is 2 million rubles (i.e. you can return 2 million rubles x 13% = 260 thousand rubles). But for 2018 itself, Ivanov will be able to return only 78 thousand rubles of the income tax he paid (and he will be able to return 182 thousand in the following years).

Example 2: Receiving a deduction by an individual entrepreneur using the simplified tax system

Conditions for purchasing property:

In 2018 Petrov P.P. bought an apartment for 3 million rubles.

Income and income tax paid:

Petrov P.P. works as an individual entrepreneur under a simplified taxation system and, accordingly, does not pay personal income tax at a rate of 13% (income tax).

Calculation of deduction:

The maximum deduction amount for an apartment is 2 million rubles. (i.e. you can return until 2 million rubles x 13% = 260 thousand rubles). But since Petrov P.P. did not pay income tax in 2018, he will not be able to receive a tax deduction for this year. If Petrov P.P. in the future, if he gets another job (where he will pay income tax), he will be able to apply for a tax deduction and get back up to 260 thousand rubles.

Example 3: Buying an apartment with a mortgage

Conditions for purchasing property:

In 2018, Ivanov I.I. purchased an apartment for 8 million rubles, while he took out a mortgage loan for 6 million rubles. According to mortgage loan interest in 2018, Ivanov I.I. paid 100 thousand rubles.

Income and income tax paid:

Ivanov I.I. earned 3 million rubles in 2018, from which he paid income tax.

Calculation of deduction:

The maximum deduction amount for property is 2 million rubles. Additionally Ivanov I.I. can receive a tax deduction in the amount of 100 thousand rubles. on mortgage interest paid. Total for 2018 Ivanov I.I. will be able to return 2 million 100 thousand rubles. x 13% = 273 thousand rubles. He will be able to return this entire amount at once, because... the income tax he paid is more than 273 thousand rubles.

In subsequent years, Ivanov I.I. may also receive a tax deduction on mortgage interest (direct housing deduction has already been exhausted). Moreover, since the loan agreement was concluded after January 1, 2014, the maximum amount of mortgage interest deduction that he can receive is 3 million rubles. (390 thousand rubles to be returned).

Example 4: Purchase of property by spouses in joint ownership (from January 1, 2014)

Conditions for purchasing property:

In 2018, the couple Vasilyev V.V. and Vasilyeva A.A. purchased an apartment worth 5 million rubles. into joint ownership.

Income and income tax paid:

For 2018 Vasilyev V.V. earned 2.5 million rubles, and Vasilyeva A.A. 3 million rubles

Calculation of deduction:

In case of joint ownership, the tax deduction can be redistributed in any shares. At the same time, from January 1, 2014, the deduction limit in the amount of 2 million rubles was lifted. to a housing facility. The Vasiliev spouses can distribute the tax deduction in equal shares (50% to the husband and 50% to the wife), and in 2019 each of them will receive a deduction in the amount 2 million rubles (maximum deduction amount per person) × 13% = 260 thousand rubles.

Example 5: Purchase of property by spouses in joint ownership (before January 1, 2014)

Conditions for purchasing property:

In 2013, the couple Vasilyev V.V. and Vasilyeva A.A. purchased an apartment worth 5 million rubles. into joint ownership.

Income and income tax paid:

Vasilyeva A.A. does not work.

Calculation of deduction:

In case of joint ownership, the tax deduction can be redistributed in any shares, but since the housing was purchased before 2014, the maximum deduction amount for both spouses is 2 million rubles. The Vasiliev spouses can distribute 100% of the tax deduction (2 million rubles) to V.V. Vasiliev. Despite the fact that the apartment was purchased in 2013, in 2019 Vasiliev can submit a declaration only for the last three years: 2018, 2017 and 2016.

Example 6: Purchase of property in shared ownership (from January 1, 2014)

Conditions for purchasing property:

In 2018, Vasiliev V.V. and Romashkova A.A. purchased an apartment worth 5 million rubles. into common shared ownership (each of them owns ½ of the apartment).

Income and income tax paid:

For 2018 Vasilyev V.V. earned 2.5 million rubles, from which he paid income tax. Romashkova A.A. did not work.

Calculation of deduction:

In case of shared ownership, the tax deduction is distributed among the owners in accordance with their shares. Moreover, for housing purchased after January 1, 2014, the limit of 2 million rubles was lifted. for the entire property. Based on this and the shares of the owners (50% each), V.V. Vasiliev. and Romashkova A.A can be provided with up to 2 million rubles. (maximum deduction amount per person) property tax deduction. At the same time, in 2019 Vasiliev will be able to regain 2 million rubles × 13% = 260 thousand rubles. for 2018, and Romashkova will be able to receive a tax deduction when she gets a job (and pays income tax).

Example 7: Purchase of property in shared ownership (before January 1, 2014)

Conditions for purchasing property:

In 2013, Vasiliev V.V. and Romashkova A.A. purchased an apartment worth 5 million rubles. into common shared ownership (each of them owns ½ of the apartment).

Income and income tax paid:

Romashkova A.A. does not work.

Calculation of deduction:

In case of shared ownership, the tax deduction is distributed among the owners in accordance with their shares. At the same time, for housing purchased before January 1, 2014, there is a limit of 2 million rubles. for the entire property. Based on this limitation and the shares of the owners (50% each), Vasiliev V.V. and Romashkova A.A can be provided with up to 1 million rubles. property tax deduction. At the same time, in 2019, Vasiliev will be able to submit a 3-NDFL declaration and return 1 million rubles × 13% = 130 thousand rubles. for 2018, 2017 and 2016. Romashkova will be able to receive a tax deduction only when she gets a job (and pays income tax).

Romashkova does not have the right to refuse a tax deduction in favor of V.V. Vasiliev. (as is possible with joint ownership).

Example 8: Buying an apartment using maternity capital

Conditions for purchasing property:

In 2018, Vasilyeva E.E. purchased an apartment for 1.7 million rubles, with 400 thousand rubles. She paid for it using maternity capital funds.

Income and income tax paid:

In 2018, Vasilyeva earned 1 million rubles, from which she paid 130 thousand rubles. income tax.

Calculation of deduction:

A tax deduction is not provided for the amount of maternity capital, so the deduction amount for Vasilyeva will be 1700 thousand rubles. – 400 thousand rubles. = 1300 thousand rubles.(i.e. she can return it before 1300 thousand rubles. x 13% = 169 thousand rubles.). At the same time, in 2019, for 2018, Ivanova will be able to return only 130 thousand rubles of income tax paid to her. 39 thousand rubles. she will be able to return in the following years.

Example 9: Property acquired before 2008

Conditions for purchasing property:

In 2007, Sidorov S.S. I bought an apartment for 2 million rubles, but Sidorov decided to receive a tax deduction for this apartment only in 2019.

Amount of income tax paid:

In 2016-2018 Sidorov S.S. earned 360 thousand rubles a year and paid 46 thousand rubles a year in income tax.

Calculation of deduction:

For property acquired before 2008, the maximum tax deduction amount is 1 million rubles. (accordingly, the maximum amount that Sidorov can return will be equal to 1 million rub. x 13% = 130 thousand rubles.).

According to the law, a tax deduction can be issued for no more than the last 3 years (not earlier than 2016 in our case).

Therefore, in 2019, Sidorov S.S. will be able to issue a deduction and return 46 thousand rubles. for 2016, 46 thousand rubles. for 2017 and 38 thousand rubles. for 2018. After which the deduction will be completely exhausted.