Management of funds in a bank account. Sample power of attorney to manage a bank account: what it looks like and where to get it. features of limiting the disposal of an account in bankruptcy proceedings

At the same time, claims of creditors for payment for goods supplied, services rendered and work performed that arose after the initiation of bankruptcy proceedings are considered current. Claims of creditors for such payments are not included in the register of claims and such creditors are not recognized as persons participating in the bankruptcy case. Pay attention to the Plenum of the Supreme Arbitration Court of the Russian Federation in its resolution of July 23, 2009 No. 63, clarified that only an obligation that involves the use of money as a means of payment, a means of repaying a monetary debt can be qualified as a current payment. It should also be borne in mind that Law No. 127-FZ does not contain an order on the inadmissibility of using a bank account by a debtor, in respect of which a monitoring procedure has been introduced. And one more argument.

Using a bank account during the observation procedure

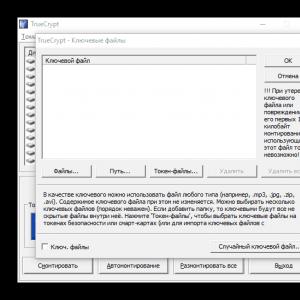

The exceptions are cases when the violation of the rules by the manager is obvious to any reasonable person - in such a situation, the credit institution is not entitled to execute the order, and in case of its execution it bears property liability. Powers to Dispose of the Debtor's Accounts after the Initiation of Bankruptcy Proceedings From the date the debtor is declared bankrupt, a credit institution shall not be entitled to execute orders to conduct operations on the debtor's account signed by the head of the debtor - a legal entity or the debtor - an individual, as well as by the representative of the debtor, who, prior to the commencement of bankruptcy proceedings, was power of attorney issued.

In case of bankruptcy individual a credit institution is not entitled to debit funds from his account under any orders, except for cases specially stipulated by the Law (clause 2, article 207 of the Bankruptcy Law).

Current payments in the monitoring procedure

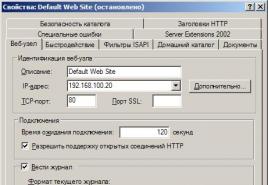

Letter of the Ministry of Finance of the Russian Federation No. 03-02-07/1/47850 dated August 19, 2015 Question: On the suspension of operations on an organization's bank account if a monitoring procedure has been introduced in relation to it. Answer: The Department of Tax and Customs Tariff Policy considered the appeal and reported the following.

According to paragraph 1 of Article 76 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), the suspension of operations on bank accounts and electronic money transfers is used to ensure the execution of a decision to collect a tax, fee, penalties and (or) fine, unless otherwise provided by paragraph 3 of this article. and subparagraph 2 of paragraph 10 of Article 101 of the Code.

Order of payments during the monitoring procedure

The documents must contain specific data confirming that the obligation is classified as current. In the absence of information sufficient to formally classify the paid claim of the recipient of funds as current payments or other claims for which payment from the debtor's account is allowed in the course of the relevant procedure, the credit institution returns the instruction to the person who provided it, indicating the reason for the return.

A credit institution that debited funds from the debtor's account in violation of the established order is liable in the form of compensation for losses on the basis of Art. 15, 393, 401 of the Civil Code of the Russian Federation.

Article 133. Accounts of the debtor in the course of bankruptcy proceedings

Clause 7.11 of the Instruction of the Central Bank of the Russian Federation dated September 14, 2006 No. 28-I “On opening and closing bank accounts, accounts for deposits (deposits)” provides that the bankruptcy trustee (liquidator), the external trustee affix an imprint of the seal used by them in the bankruptcy proceedings (liquidation), external management. As you can see, the instruction does not contain a requirement to provide the bank with an imprint of the seal of the interim manager who exercises supervision.

The use of the client's seal during the monitoring procedure indicates the possibility of carrying out transactions on the account. In paragraph 2 of Art. 63 of Law No. 127-FZ, in particular, provides for the direction of the arbitration court ruling on the introduction of supervision to credit institutions with which the debtor has a bank account agreement in order to ensure the occurrence of the consequences provided for in this article.

Suspension of operations on the account when the monitoring procedure is introduced

For violation of this requirement, the credit institution shall be liable in the form of compensation for losses caused to the debtor (bankruptcy estate). Consequences of the introduction of the procedures applied in a bankruptcy case in relation to the suspension of operations on the accounts of the debtor previously carried out by the tax authority The Plenum of the Supreme Arbitration Court explained that Art.

63 of the Bankruptcy Law does not provide for the cancellation of the suspension of operations on the debtor's account, made by the tax authority before the introduction of the monitoring procedure. At the same time, the suspension does not apply to payments, the order of which precedes the fulfillment of the obligation to pay taxes and fees in accordance with Art.

134 of the Bankruptcy Law. From the date of the introduction of the financial rehabilitation procedure, external management or bankruptcy proceedings, the suspension of operations is terminated automatically, of which the credit institution notifies the tax authority.

4. Peculiarities of limiting account management in bankruptcy proceedings

Important

In addition, a credit institution has the right to demand compensation for the amount of losses paid by it from the creditor to whom it transferred money from the debtor's account, if at the time of receipt of the funds the creditor knew or should have known about the introduction of bankruptcy proceedings against the debtor. After the creditor compensates the bank for losses, the creditor's previously extinguished claim against the debtor shall be restored.

Attention

Features of checking the order of current payments and the delimitation of responsibility of the credit institution and the arbitration manager Control over compliance with the provisions of paragraph 2 of Art. 134 of the Bankruptcy Law, the order of current payments in any bankruptcy procedure when spending money from the debtor's account is assigned to the credit institution. At the same time, when determining the priority, documents that are exclusively informational, and not administrative in nature, are not taken into account.

The first stage of the bankruptcy procedure of a legal entity is supervision

Article 64 of Law No. 127-FZ states that the introduction of supervision is not a basis for the removal of the head of the debtor and its other management bodies that continue to exercise their powers, subject to the restrictions established by this article. In particular, these bodies can make only with the consent of the interim manager, expressed in writing, with the exception of cases expressly provided for by law, transactions or several interconnected transactions related to: the book value of which is more than 5% of the book value of its assets as of the date of introduction of supervision; - obtaining and issuing loans (credits), issuing sureties and guarantees, assignment of rights of claim, transfer of debt, as well as with the establishment of trust management of the debtor's property.

In this regard, banking institutions, as well as creditors for current obligations of persons, in respect of which any of the procedures applied in a bankruptcy case, are introduced, in case of contesting payments and filing claims for damages, professional support of specialists in the field of bankruptcy is recommended. Consultant's assistance Pepeliaev Group's specialists have extensive experience in protecting the interests of all categories of persons involved in bankruptcy procedures and provide qualified legal assistance, including in litigation related to contesting debtor's payments made in violation of the order provided for in Art. 5 and paragraph 2 of Art. 134 of the Bankruptcy Law, or with compensation for damages caused by such violations.

Disposal of the debtor's accounts at the monitoring stage

Making transactions involves the implementation of settlements on them. Consequently, the debtor, represented by authorized representatives, subject to the restrictions established by law, has the right to give instructions to the bank to carry out operations on his bank account.

Our conclusion is confirmed by the norms of Art. 63 of Law No. 127-FZ, according to which the claims of creditors for monetary obligations and for the payment of mandatory payments, with the exception of current payments, can be presented to the debtor only in compliance with the procedure established by law for their presentation. We note that according to Art. 5 of Law No. 127-FZ, current payments are understood to be monetary obligations and mandatory payments that arose after the date of acceptance of the application for declaring the debtor bankrupt.

Disposition of the debtor's accounts at the monitoring stage is carried out by

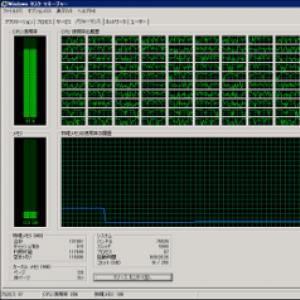

The greatest difficulty in assessing the legitimacy of banks' actions to execute orders to transfer funds from debtors' accounts is the question of what is considered a sufficient degree of verification by the bank of payment documents in terms of authority to manage the account and establish the nature and sequence of payments. Changes in Practice On July 11, 2014, Resolution No. 36 of the Plenum of the Supreme Arbitration Court of the Russian Federation dated June 6, 2014 “On Certain Issues Related to Maintaining Bank Accounts of Persons Under Bankruptcy Procedures by Credit Institutions” was published.

The aforementioned Resolution clarifies controversial issues that have arisen in judicial practice in relation to assessing compliance with the order of execution of orders to transfer funds from the accounts of the debtor (with the exception of the debtor - a credit institution) and compensation for losses caused by a violation of the order.

According to Article 858 of the Civil Code of the Russian Federation, restriction of the client's rights to dispose of the funds on the account is not allowed, with the exception of seizing the funds on the account or suspending operations on the account in cases provided for by law. At the same time, clause 3 of Article 845 of the Civil Code allows for the possibility of limiting the disposal of funds on the account in cases established by the agreement between the client and the bank. authorized state bodies not participating in the bank account agreement into these contractual relations.

Legislation Russian Federation two types of such restrictions are known: the arrest of funds on the account and the suspension of operations on the account. Let's consider them in order.

According to Article 27 of the Federal Law “On Banks and banking» dated December 2, 1990 N 395-I (hereinafter - the law on banks) for cash and other valuables of legal entities and individuals , which are on accounts and in deposits or stored in a credit institution, the arrest can be imposed only by a court and an arbitration court, a judge, as well as by order of the preliminary investigation bodies if there is a prosecutor's sanction. In addition to this law, the possibility of seizing funds is also provided for in other federal laws. According to them, the right to arrest funds in the account has:

a) courts (judges) in civil and criminal cases pending before them, as a measure to secure a claim,enforcement of a sentence in terms of a civil claim, other property penalties or possible confiscation of property in criminal cases (Article 140 of the Code of Civil Procedure of the Russian Federation, 91 of the Arbitration Procedure Code of the Russian Federation, Article 230 of the Code of Criminal Procedure of the Russian Federation);

b) bodies of preliminary investigation in criminal casesas a measure to ensure the execution of a sentence in terms of a civil claim, other property penalties or possible confiscation of property in criminal cases (prosecutor, investigator or interrogating officer with the consent of the prosecutor and in the presence of a court decision (Article 115 of the Code of Criminal Procedure of the Russian Federation);

c) bailiffs for the purpose of subsequent recovery of funds (Article 46 of the Federal Law “On Enforcement Proceedings”).

In accordance with Article 27 of the Federal Law of the Law on Banks, when seizing funds on accounts and deposits, a credit institution immediately upon receipt of a decision to seize shall terminate debit transactions on this account (deposit) within the limits of the funds seized. Part 7 of Art. . 115 of the Criminal Code of the Russian Federation also provides that when seizing funds and other valuables belonging to a suspected accused, which are on an account, in a deposit or in storage in banks and other credit organizations, operations on this account are terminated in whole or in part within the limits of the funds for which imposed arrest. Other legislative acts do not describe the procedure for seizing funds in an account (in a deposit). Thus, the arrest of funds on an account with a credit institution should be understood as the blocking of a certain amount of money on the account on which the arrest is made, and the exclusion of the possibility of its write-off. Higher arbitration court Russia clarified to the lower courts that the arrest is imposed on the funds in the account, and not on the account itself. That is, it is impossible to seize if there are no funds on the account. If by the time the bank receives the arrest order, the balance of the account exceeds the amount seized, then in terms of the excess, the client can freely dispose of the funds, if the balance is less than the amount seized, the arrest is imposed on the existing the amount of funds. But, and if there are no funds on the account at all, then the bank returns the seizure document and notifies the person authorized to arrest that there are no funds in the account. about the amount, but also to block the amounts that will be credited to the account in the future. Of course, the arrest of amounts credited to the account in the future does not fit into the legislative definition of arrest, and such requirements seem unlawful. However, the seizure of funds in its current form is ineffective. By the time the bank receives the arrest order, there may not be funds on the account, but they may be credited to it later, when the bank has already responded to the person authorized to arrest about non-execution or partial non-execution of the arrest order due to the absence (full or partial) funds on it. This circumstance should be recognized as a shortcoming of the current legislation, since the possibility of achieving the goals for which the arrest is actually made is sharply reduced. It appears that de lege ferenda it is necessary to change the mode of arrest of funds on the account, directly providing in the legislation for the possibility of arrest of funds coming to the account in the future.

We cannot agree with the opinion of F. Gizatullin that “when funds on the account are arrested imposed by the courts of general jurisdiction by virtue of 390 Code of Civil Procedure of the Russian Federation, as well as for the arrest imposed by the decision of the bailiff - executor on the arrest and write-off of funds by virtue of clause 12.7 of Regulations of the Bank of Russia of October 3, 2002 N 2-P "On non-cash payments in the Russian Federation", the accumulative method is used, since in accordance with the indicated norms, all payments due to the client until the full repayment of the amount collected must be transferred to the claimant or to the deposit account of the court. » .From the norms given by the author, this does not follow at all! The accumulative method is used in the execution of an executive or settlement document for the recovery, and not the decision of the authorized body to seize funds.

The seizure of funds does not mean that the claim secured by the seizure takes precedence over other claims presented to the account, that is, the order of debiting established by Art. 855 of the Civil Code of the Russian Federation continues to operate.

The suspension of operations on accounts is not mentioned in the Banking Law itself, but is provided for by the following legislative acts:

a ) the Tax Code of the Russian Federation as the powers of the tax and customs authorities (Articles 34.76);

b) Federal Law No. 115-FZ dated 07.08.2001 “On Counteracting the Legalization (Laundering) of Proceeds from Crime and the Financing of Terrorism” as the powers of the authorized body for financial monitoring and the banks themselves (Articles 7, 8);

c) the Budget Code of the Russian Federation as the powers of the federal treasury bodies (Articles 282, 284).

According to paragraphs 1, 2 Art. 76 of the Tax Code of the Russian Federation, the suspension of operations on the accounts of an organization is applied in order to ensure the execution of the decision of the tax (customs) authority to collect a tax (fee) or in case of failure to submit a tax declaration, and on the accounts of an individual entrepreneur - only in case of failure to submit a declaration. The definition of a bank account on which the suspension of operations is possible is given in Art. 11 of the Tax Code of the Russian Federation. On the accounts of a taxpaying organization, the suspension of operations means, in accordance with paragraph 1 of Article 76 of the Tax Code, the termination by the bank of all debit transactions on this account, unless otherwise provided by this article. Otherwise provided for in the same paragraph of the article: the account holder may make debit transactions from the account if these payments, according to the order of execution established by civil law, precede the fulfillment of the obligation to pay taxes and fees. Such a priority is established by Article 855 of the Civil Code of the Russian Federation for cases where the funds on the account are not enough to satisfy all the requirements for the account, but for the purposes of Art. 76 of the Tax Code, it is not the sufficiency of funds in the account that matters, but the purpose of the payment when debiting. Write-offs in order to fulfill the obligation to pay taxes and fees are preceded by the write-offs of the first and second stages, established by paragraph 2 of Art. 855 of the Civil Code of the Russian Federation: write-off under executive documents providing for the transfer or issuance of funds from an account to satisfy claims for compensation for harm caused to life and health, as well as claims for the recovery of alimony, write-off under executive documents providing for the transfer or issuance of funds for settlements on payment of severance pay and wages with persons working under an employment contract, including under a contract, for the payment of remuneration under an author's agreement. In this case, it turns out to be impossible to pay wages to employees of the organization, since the write-off for it turned out to be in the same queue as the payment of taxes and fees, but it is possible to write off wages to employees according to executive documents on the basis of a court decision (second stage).

The possibility of debiting funds from the account in fulfillment of the obligation to pay taxes and fees in cases of suspension of operations on the account causes great controversy. There are two opinions. According to the first, based on the targeted interpretation of the norms of Art. 76 of the Tax Code of the Russian Federation, it is recognized that if operations are suspended due to non-payment of tax, then the bank is obliged to execute the order of the client or the tax authority aimed at paying (collecting) the tax. The argument of the supporters of this opinion is also the disposition of Art. 134 of the Tax Code of the Russian Federation, according to which the execution by the bank, if it has a decision of the tax authority to suspend operations on the accounts of the taxpayer, the payer of the fee or the tax agent, of their order to transfer funds to another person, not related to the fulfillment of obligations to pay a tax or fee or other payment order, which, in accordance with the legislation of the Russian Federation, has an advantage in the order of execution over payments to the budget (off-budget fund) entails the liability of the bank in the form of a fine.

The second opinion is based on a literal interpretation and proceeds from the impossibility of debiting the account in order to pay (collect) taxes. Such an opinion is in some cases shared by arbitration practice. Of interest are the conclusions contained in the decision of the Arbitration Court of the Krasnoyarsk Territory dated October 14, 2003. In the reasoning part of its decision, the Court referred to the procedure for filing a claim for payment of tax, making a decision to collect tax, collection, as well as penalties at the expense of the funds of the taxpayer (payer of fees) - organization or tax agent - organization on bank accounts and the decision to suspend operations on the accounts of the taxpayer (payer of fees) or tax agent in the bank, approved. by order of the Ministry of Taxation of the Russian Federation of April 2, 2003 N BG-3-29 / 159. According to clause 7 of the Procedure, only decisions (on suspension of operations - A.A.) are sent to banks on those accounts for which the tax authority does not issue collection orders. Indeed, the payment document for the fulfillment of the tax obligation is actually executed in the third order (taking into account the norm of Article 26 of the Federal Law of December 23, 2004 N 173-FZ "On the Federal Budget for 2005"). This means that regardless of whether operations are suspended or not, payments of the first and second priority must still be executed before tax is paid. And payments of the fourth and fifth queues do not go through until taxes are paid. In addition, only if the second point of view is adopted does sec. 2 p. 3 art. 75 of the Tax Code of the Russian Federation, which does not accrue penalties for the amount of arrears, which the taxpayer could not repay due to the fact that, by decision of the tax authority or the court, the taxpayer's operations in the bank were suspended. With the support of the first position, payments that are in the same queue as taxes, and this is wages under employment contracts, are infringed, which contradicts the legal position of the Constitutional Court of the Russian Federation, set out in Resolution No. 21-P of December 23, 1997. Only if we allow the possibility of their payment can we accept the first point of view.

If there is a decision to suspend operations on the organization's accounts, the bank is not entitled to open new accounts for this organization (clause 9 of article 76 of the Tax Code).

Another legislative act regulating the suspension of operations on bank accounts is Federal Law No. 115-FZ of August 7, 2001 "On countering the legalization (laundering) of proceeds from crime and the financing of terrorism". According to its paragraph 10, Art. 7 organizations that carry out transactions with cash or other property, including credit institutions, suspend such transactions, with the exception of transactions for crediting funds received to the account of an individual or legal entity, for two business days from the date when the orders of customers about their implementation must be fulfilled, and no later than the working day following the day of suspension of the operation, provide information about them to the authorized body if at least one of the parties is an organization or an individual in respect of which there are received in accordance with the established in accordance with paragraph 2 of article 6 of the said law on the procedure for reporting their participation in terrorist activities, or a legal entity directly or indirectly owned or controlled by such an organization or person, or an individual or legal entity acting on behalf of or at the direction of such an organization or person. Such lists are sent to credit institutions by the Federal Financial Monitoring Service in accordance with the procedure established by Decree of the Government of the Russian Federation of January 18, 2003 N 27. If within the specified period a decision of the authorized body on suspension of the relevant operation for an additional period is not received on the basis of part three of Article 8 of this Federal Law, organizations carry out a transaction with cash or other property at the order of the client, unless otherwise decided in accordance with the legislation of the Russian Federation restricting its implementation.

The authorized body issues a decision to suspend operations on accounts for a period of up to five working days if the information received by it in accordance with paragraph 10 of Article 7 of the law, based on the results of a preliminary check, is recognized by it as justified (paragraph 3 of Article 8).

In these cases, in contrast to the suspension of transactions by the tax (customs) authority, all debit transactions are suspended, regardless of the order established by civil law. The differences also consist in the fact that, firstly, the suspension of operations begins from the date when the client’s order to debit must be executed, that is, no later than the next business day following the day the client gave the order, unless another period is established by law or by a bank agreement. account (Article 849 of the Civil Code of the Russian Federation), and secondly, it has an expiration date, after which it automatically becomes invalid. In view of all this, it seems ineffective, given its maximum period of five days and the lack of authority to somehow decide the fate of the funds on the account . If in other cases funds can be blocked on the account until their subsequent collection, then in this case the authorized body does not have such rights. The only thing he can do for the authorized body is to send information and materials to law enforcement agencies, but as long as he does this, the five-day period will pass.

The legislation of the Russian Federation also provides for the suspension of operations on accounts in credit institutions as a measure against violators of budget legislation (Article 282 of the Budget Code of the Russian Federation). In accordance with part 3 of article 284 of the RF BC, the heads of the Federal Treasury, its territorial bodies have the right to suspend, in the cases provided for by the budgetary legislation of the Russian Federation, in the manner established by the Government of the Russian Federation, operations on personal accounts opened with the bodies of the Federal Treasury to the chief administrators, administrators and recipients of federal budget funds, and accounts opened by recipients of federal budget funds in credit institutions. In relation to bank accounts, such a case is provided for by Article 117 of the Federal Law of December 23, 2004 N 173-FZ "On the Federal Budget for 2005" when establishing the fact that federal institutions did not close accounts in the currency of the Russian Federation opened by them with institutions of the Central Bank of the Russian Federation and credit institutions for accounting for transactions with funds received from entrepreneurial and other income-generating activities. The procedure for suspending operations in this case must be established by the Government of the Russian Federation. However, for cases of suspension of operations specifically on bank accounts, Decree of February 14, 2004 N 80 "On measures to implement the Federal Law" On the federal budget for 2004 "approval of this procedure was entrusted to the Ministry of Finance of the Russian Federation in agreement with the Central Bank of the Russian Federation. Order of the Ministry of Finance of the Russian Federation of October 26, 2004 N 94n approved the Procedure for the suspension by federal treasury bodies of operations on accounts opened by federal institutions in institutions of the Central Bank of the Russian Federation and credit institutions (branches) for accounting operations with funds received from entrepreneurial and other income-generating activities According to paragraph 8 of the Procedure, the suspension of operations on accounts of federal institutions in a bank means the termination by the bank of all operations to write off funds, with the exception of the performance of obligations federal agency for the payment of tax payments to the budget and payments, the order of execution of which, in accordance with civil law Russian Federation, precedes the fulfillment of the obligation to pay taxes and fees, as well as, with the exception of transferring, on the basis of a payment order from a federal institution, the amount of the balance of funds on an account opened with a bank to the account of a federal treasury body.

The decision of the federal treasury body is subject to execution by the bank from the moment it is received and until the account is closed by the federal institution.

With any of the types of restrictions on the disposal of an account, it is debatable that it is possible to close an account with the available balance of funds on it and dispose of them (Article 859 of the Civil Code of the Russian Federation). The client's right to terminate the bank account agreement and, accordingly, close the account at any time is unconditional, however, the free disposal of the account balance upon closing it is in fact not consistent with the restrictions on debit transactions that are established upon arrest and suspension of account operations. In this case, having received a client's application for closing an account with a balance and arrest or suspension of operations, the bank should not accept it for execution. A similar opinion of the tax authorities is set forth in the Letter of the Ministry of Taxation of the Russian Federation dated September 16, 2002 N 24-1-13 / 1083-AD665.

Certain difficulties may also be caused by the issue of competition between several acts of limiting funds on the account. It is quite real when operations are suspended on the account with seized funds, or vice versa. Which act should be preferred? Both types of restrictions are established by federal laws and both are aimed at achieving constitutionally significant goals: the execution of judicial decisions and taxes. Judicial practice proceeds from the impossibility of executing the decision to suspend operations in the event of arrest of funds in the account. It seems to me that in such a situation it would be more correct not to completely exclude the possibility of the execution of a decision on arrest (suspension of operations) coming to the bank later in time, but to exclude it to the extent that this execution contradicts the previous decision.

S. V. Sarbash. Bank account agreement: problems of doctrine and judicial practice. M. "Statute". 1999- p. 155

See p. 6 Decree of the Plenum of the Supreme Arbitration Court of the Russian Federation of October 31, 1996 No. 13 “On the application of the Arbitration Procedure Code of the Russian Federation when considering cases in the court of first instance”, as well as p. thirteen Decisions of the Plenum of the Supreme Arbitration Court of the Russian Federation of December 9, 2002 N 11 "On some issues related to the implementation of the Arbitration Procedure Code of the Russian Federation" / / SPS "Garant" individual entrepreneurs.

Taking into account the content of the Resolution of the Constitutional Court of the Russian Federation of December 23, 1997 No. 21-P "On the case of checking the constitutionality of paragraph 2 of Article 855 of the Civil Code of the Russian Federation and part six of Article 15 of the Law of the Russian Federation "On the Fundamentals of the Tax System in the Russian Federation" and Article 26 Federal Law No. 173-FZ of December 23, 2004 "On the Federal Budget for 2005"

cm. F. Gizatullin. Decree op., as well as Resolution of the Federal Arbitration Court of the East Siberian District of January 23, 2004 NА33-1874/03-С3-Ф02-4976/03-С1; Resolution of the Federal Arbitration Court of the Urals District of June 23, 2003 N Ф09-1745 / 03AK; Resolution of the Federal Arbitration Court of the Urals District of March 3, 2003 N Ф09-501 / 03AK; letter of the Ministry of Taxation dated No. // SPS "Garant"

The inconsistency of Art. 134 Tax Code Art. 76 was reflected in paragraph 47 of the Decree of the Plenum of the Supreme Arbitration Court of the Russian Federation of February 28, 2001 N 5 "On Some Issues of Applying Part One of the Tax Code of the Russian Federation."

See the decision of the Arbitration Court of the Krasnoyarsk Territory of October 14, 2003 N A33-11564 / 03-C3, upheld by the Decree of the Federal Arbitration Court of the East Siberian District of March 4, 2004 N A33-11564 / 03-S3-F02-621 /04-C1;Decree of the Federal Arbitration Court of the Volga District of April 16, 2002 N A65-15261 / 2001-CA1-7k;Resolution of the Federal Arbitration Court of the North Caucasus District of February 20, 2001 N F08-288 / 2001 // SPS "Garant"

Resolution of the Federal Arbitration Court of the Central District of May 14, 2003 N A64-9 / 02-11 Resolution of the Federal Arbitration Court of the Moscow District of October 19, 2004 N KA-A40 / 9323-04 // SPS "Garant"

Card with samples of signatures and seal imprints on the basis of paragraph 1 of Art. 847 of the Civil Code of the Russian Federation is a document certifying the rights of specific persons to dispose of funds on the account (hereinafter referred to as the Card).

The procedure for issuing and filling out the Cards is regulated by the Bank of Russia2.

The card must be issued when opening not only bank accounts, but also deposit accounts (deposit accounts).

The right of the first signature belongs to the client - physical

a physical person, an individual entrepreneur, an individual

to a private person engaged in private practice, as well as

may belong to such individuals on the basis of

nii corresponding power of attorney.

At legal entities the right of first signature belongs to

manager (sole executive body),

as well as other persons vested with the right of first signature

administrative act of the head of the legal entity,

or on the basis of a power of attorney. At the same time, the right of the first

signature can be transferred to the manager or manager

organization.

The right of the second signature belongs to the chief accountant

ru client - a legal entity or persons authorized by

nym for accounting, on the basis of

ordering act of the head of the legal entity.

If accounting is transferred

third parties, they may also be granted the right

1 Paragraph 2 of clause 1.2 of Instructions of the Central Bank of the Russian Federation of September 14, 2006 No. 28-I

"On the opening and closing of bank accounts, deposit accounts

(deposits).

2 See: Chapter 7 of Instructions of the Central Bank of the Russian Federation dated September 14, 2006 No. 28-I “On opening and closing bank accounts, deposits (deposits) accounts”.

second signature on the basis of an administrative act of the head of the client - a legal entity.

The right of the first or second signature may be given simultaneously to several employees of a legal entity.

Giving one natural person the right of first and second signature at the same time is not allowed.

The authenticity of the handwritten signatures of the persons entitled to the first or second signature may be certified either by a notary public or by an authorized person of the credit institution in the presence of the persons indicated in the Card.

The card is valid until the termination of the agreement between banks -

bank account, closing an account on a deposit (deposit) or before

replacing it with a new card.

In case of replacement or addition of at least one signature

si is presented with a new card.

If the right of the first or second signature is pre-

delivered temporarily to persons not specified in the card,

temporary cards are presented to the card. Wherein

in the upper right corner on the front of the card

marked "Temporary".

6.3.7. Main elements of the legal regime of bank accounts

Account credit

(overdraft)

In accordance with paragraph 1 of Art. 850 of the Civil Code of the Russian Federation, if it is provided for by the bank account agreement, the bank may

make payments from the account despite the absence of funds on it (account crediting). In this case, the bank is considered to have provided the client with a loan for the corresponding amount from the date of such payment.

Accordingly, crediting an account (overdraft) is one of the methods of bank lending.

The Bank of Russia allows the use of this option for accounts of individuals, if the corresponding condition is stipulated by the bank account agreement or the bank deposit agreement.

At the same time, crediting of the account (overdraft) must necessarily be carried out with the established limit (i.e., the maximum amount for which the specified operation can be carried out) and the period during which the emerging credit obligations of the client of the credit institution must be repaid1.

Formed when crediting an account (overdraft) on

bank account, the debit balance at the end of the day is carried forward

to accounts for accounting for loans granted to customers2.

Bank account agreement, which provides for credit

dividing the account of a client of a credit institution, must

be considered as mixed (clause 3 of article 421 of the Civil Code of the Russian Federation).

If a credit institution receives an application from a client

ent to terminate the bank account agreement or close

ii account, the above mixed contract by virtue of paragraph 3

Art. 450 of the Civil Code of the Russian Federation is considered amended. Duty credit-

organization for lending is terminated, and the client

that, in accordance with the terms of the contract, must be returned

pay the actually received loan amount and pay

interest for use. In the absence of special instructions

knowledge in the contract to the legal relations of the parties in accordance with clause 2

Art. 850 of the Civil Code of the Russian Federation, the rules on loans and credit apply (Chapter 42

Based on Art. 858 of the Civil Code of the Russian Federation, in cases provided for by federal law, it is allowed to introduce restrictions on the rights of clients.

Account restrictions

enta on the disposal of accounts in the form of seizure of funds or suspension of operations on the account.

1 Subparagraph 3, clause 2.2 of the Regulations on the procedure for the provision (placement) of funds by credit institutions and their return (repayment), approved. Central Bank of the Russian Federation 31.08.1998 No. 54-P.

2 Clause 1.14, Part I of the Regulations on the Rules for Maintaining Accounting in Credit Institutions Located on the Territory of the Russian Federation, approved. Central Bank of the Russian Federation 16.07.2012 No. 385-P.

3 Paragraph 15 of the Decree of the Plenum of the Supreme Arbitration Court of the Russian Federation dated April 19, 1999 No. 5 “On some issues of the practice of considering disputes related to the conclusion, execution and termination of bank account agreements”.

The main differences between the suspension of operations on the account and the arrest of funds on the account are in their content, as well as in the purpose for which they are used.

suspension is reduced to limiting the conduct of debit transactions on the account.

This measure is used to coerce certain actions. For example, in tax relations - to force payers of taxes and fees, as well as tax agents to fulfill their obligations to fulfill the decision of the tax authority to collect a tax or fee, as well as to submit tax returns. In the first case, the decision to suspend

operations on accounts in a credit institution can be taken only simultaneously or after a decision on the collection of tax has been made and only within the amount specified in this decision (clause 2, article 76 of the Tax Code of the Russian Federation).

In contrast to this arrest is always imposed on a specific amount of money in the account in order to save it for subsequent collection.

When seizing funds on accounts and deposits, the credit institution immediately upon receipt of the decision to seize shall terminate debit transactions on this account (deposit) within the limits of the funds seized (Part 2 article 27

Law on banks and banking activity).

Seizure of the debtor's funds in excess of the necessary

amount is illegal.

Suspend operations on bank accounts in

line provided for in Art. 76 of the Tax Code of the Russian Federation, tax authorities2

and customs authorities (subclause 5, clause 1, article 31, article 34 of the Tax Code of the Russian Federation, article 155

1 See, for example: paragraph 14 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 21, 2004 No. 77 “Overview of the practice of considering cases related to the execution of judicial acts of arbitration courts by bailiffs”.

2 See: Regulations on the procedure for sending to the bank an order from the tax authority, the decision of the tax authority, as well as sending the bank to the tax authority information on the balance of funds in electronic form, approved. Bank of Russia December 29, 2010 No. 365-P.

Federal Law “On Customs Regulation in the Russian Federation”).

In case of repeated non-fulfillment or improper fulfillment of the instructions of the Accounts Chamber, the Collegium of the Accounts Chamber, in agreement with State Duma may also decide to suspend all types of transactions on the accounts of inspected enterprises, institutions and organizations (Part 4, Article 27 of the Federal Law “On the Accounts Chamber of the Russian Federation”).

In addition, federal treasury bodies have the right to suspend operations on ruble accounts of budgetary institutions with the Bank of Russia and credit institutions (Clause 1, Article 166.1 of the RF BC), in the manner established by the Russian Ministry of Finance1.

The seizure of funds in a bank account is entitled to be carried out by the judicial authorities as interim measures (clause 1, part 1, article 140 of the Code of Civil Procedure of the Russian Federation, clause 1, part 1, article 91 of the APC of the Russian Federation, clause 9, part 2, article 29, part 7 article 115 of the Criminal Procedure Code of the Russian Federation, part 1 article 27 of the Law on Banks and Banking), as well as bailiffs in order to ensure the execution of a writ of execution on property recovery (article 81 of the Federal Law “On enforcement proceedings).

In addition to restrictions on the disposal of accounts in credit institutions, there are a number of other measures also aimed at restricting the rights to dispose of property.

A clear distinction between these measures is required due to the fact that their implementation is regulated by special legislative norms and by-laws.

In particular, these measures include:

1) a ban on the performance by a credit institution of certain banking operations provided for by the license issued to it, introduced by the Bank of Russia for a period of up to one year (clause 4, part 2, article 74 of the Law on the Central Bank of the Russian Federation);

1 The procedure for sending by the Federal Treasury and its territorial bodies of submissions on the suspension of operations in the currency of the Russian Federation on accounts opened by participants in the budget process in institutions of the Bank of Russia and credit institutions in violation of the budget legislation of the Russian Federation, approved. by order of the Ministry of Finance of Russia dated April 23, 2009 No. 36n.

2) suspension for two working days of debit transactions with cash and other property, applied by organizations engaged in such transactions in relation to persons involved in terrorist activities (clause 10, article 7 of the Law on Counteracting Legalization (laundering) proceeds from crime);

3) the refusal of organizations that carry out transactions with cash or other property to comply with the client’s order to make an expense transaction, for which the documents necessary to record information about this client are not submitted (clause 11, article 7 of the Law on combating the legalization (laundering) of proceeds from crime);

4) refusal of authorized banks to carry out a foreign exchange transaction in case of failure to submit the documents necessary for the implementation of foreign exchange control, or submission of unreliable documents (part 5 of article 23 of the Federal Law “On foreign exchange regulation and foreign exchange control”);

5) arrest of movable and immovable property. Such an arrest has the right to apply tax and customs authorities with the sanction of the prosecutor (Article 77 of the Tax Code of the Russian Federation), bailiffs (Article 80 of the Federal Law

“On Enforcement Proceedings”), courts in criminal cases (clause 9, part 2, article 29 and part 1, article 115 of the Criminal Procedure Code of the Russian Federation). The seizure of the debtor's property consists of an inventory of the property, announcing a ban on disposing of it, and, if necessary, restricting the right to use the property, seizing it or transferring it to storage (see, for example, Part 5, Article 80 of the Federal Law “On enforcement proceedings”, part 2 of article 115 of the Code of Criminal Procedure of the Russian Federation1);

1 On the procedure for applying arrest in criminal cases, see: Resolution of the Constitutional Court of the Russian Federation dated January 31, 2011 No. 1-P “On the case of checking the constitutionality of the provisions of parts one, three and nine of Article 115, paragraph 2 of part one of Article 208 Criminal - procedural code of the Russian Federation and paragraph nine of clause 1 of article 126

Federal Law “On Insolvency (Bankruptcy)” in connection with

complaints of the closed joint-stock company "Nedvizhimost-M", about

Limited Liability Company “Solomatinskoye Khlebopri-

debt enterprise” and citizen L. I. Kostareva”.

6) foreclosure on the debtor's rights of claim against a third party, including payment for goods actually delivered by the debtor, work performed or services rendered, for hire, rent, etc., i.e. for accounts receivable (Article 75 of the Federal Law “On Enforcement Proceedings”);

7) suspension by the bank of operations with funds on the accounts of the debtor within the amount of funds subject to collection for a period of not more than seven days to verify the authenticity of the executive document or the reliability of information about the recoverer (part 6 of article 70 of the Federal Law

"On Enforcement Proceedings").

The main difference between these measures and restrictions

on the disposal of accounts lies in the fact that they are addressed to the offenders themselves or their debtors, and not to the credit organizations serving them.

In addition, the arrest of movable property implies the possibility of seizing property from the debtor.

Thus, cash in rubles and foreign currency, precious metals and precious stones, products made from them, as well as scrap of such products are subject to mandatory seizure (Part 3, Article 84 of the Federal Law “On Enforcement Proceedings”).

When seizing funds or suspending operations on the account, the funds remain on the account with a credit institution.

In this regard, for example, in the case of arrest in the framework of criminal cases of funds held in accounts with credit institutions, Part 7 of Art. 115 of the Code of Criminal Procedure of the Russian Federation, according to which, when a court seizes the money and other valuables belonging to the suspect, the accused and other valuables that are on the account, in the deposit in banks and other credit organizations, operations on this account are terminated in full or in part within cash and other valuables that have been seized.

If we are talking about the seizure of cash, then they are withdrawn and credited to a special account in a credit institution1.

There are several points to note about the effect of restrictions on the disposal of accounts.

1. Restrictions on account management and order of payments. Suspension of operations on accounts in a credit institution means the termination of a credit institution

Nization of all debit transactions on this account, with the exception of payments, the order of execution of which, in accordance with civil law, precedes the fulfillment of the obligation to pay taxes and fees, as well as the tax payments themselves to the budget (clause 1, article 76 of the Tax Code of the Russian Federation, clause 1 article 153 of the Federal Law “On Customs Regulation in the Russian Federation”). Payments of the first type should include those provided for in paragraph 2 of Art. 855

Civil Code of the Russian Federation payments of the first and second priority, as well as payments of the third (the same as payments to the budget and non-budgetary funds) priority, but with an earlier calendar date of receipt by the bank.

The arrest of funds in the account should also not violate the

rarity of payments 2.

For this measure, this means that if,

for example, the arrest is imposed by the court as a security

measures on the claim of the counterparty of the debtor (his claims

belong to the last queue), then the arrest is distributed

only for payments of the last priority. Other payments

are carried out with the permission of the arbitration court, imposing

his arrest.

With regard to the arrest imposed under the criminal

No matter, this issue has not been directly resolved. However, by

about the complete or partial termination of operations with medium-

1 The procedure is provided for by the instruction of the Ministry of Finance of Russia dated December 30, 1997

No. 95n and the Central Bank of the Russian Federation dated 02.10.1997 No. 67 “On the procedure for enrolling and issuing

funds from current accounts for accounting for funds received during the temporary

order of the bodies of preliminary investigation and inquiry.

2 Part II of the letter of the Supreme Arbitration Court of the Russian Federation of July 25, 1996 No. 6

“On the results of consideration by the Presidium of the Supreme Arbitration Court

Russian Federation on certain issues of judicial practice”.

arrested persons, this issue must be decided by the court. Accordingly, the credit institution on this issue acts as indicated by the court.

The same approach can be used by the courts of general jurisdiction.

Suspension of operations and arrest can also be applied to electronic money (Article 76 of the Tax Code of the Russian Federation, Parts 1 and 2 of Article 27 of the Law on Banks and Banking Activities).

2. Account Disposal Restrictions and Future Account Receipts. When transactions on accounts with credit institutions are suspended, credit transactions are not suspended. An exception may be a suspension imposed by the Collegium of the Accounts Chamber in agreement with the State Duma, since in Part 4 of Art. 27

Federal Law "On the Accounts Chamber of the Russian Federation-

tions” refers to the suspension of all types of operations.

When seizing funds in accounts, this question is directly

my legislation is not regulated.

According to judicial and arbitration practice, arrest imposes -

on the funds available in the bank accounts of the defendant,

as well as on funds received on the correspondent account

bank in his name, within the declared amount of claims1.

The arbitral tribunal may also seize funds

which will be credited to the defendant's accounts in the future.

3. Cancellation of restrictions on account management.

In cases where the application of the suspension of operations

tions on accounts due to the need to compel

to the submission of a tax return, suspended

the decision is canceled by the decision of the tax authority no later than

one day following the day of its submission (paragraph 2

paragraph 3 of Art. 76 of the Tax Code of the Russian Federation).

In respect of cases where the application of this measure is

caught by the need to compel the execution of the decision of the tax authority to collect a tax or fee, paragraph 8 of Art. 76 of the Tax Code of the Russian Federation, according to which the suspension of operations on accounts is canceled by the decision of the tax authority

1 Paragraphs 15 and 16 of the Decree of the Plenum of the Supreme Arbitration Court of the Russian Federation of October 12, 2006 No. 55 “On the application of interim measures by arbitration courts”.

Ghana no later than one day following the day of submission to the tax authority of documents confirming the fact of tax collection. The same rule is established in paragraph 4 of Art. 153 of the Federal Law “On Customs Regulation in the Russian Federation” in relation to customs payments.

If the claim is satisfied, the arrest as a security

naya measure retains its effect until the actual execution

amendment of the judicial act, which completed the consideration

cases on the merits.

In case of refusal to satisfy the claim, leaving the claim

without consideration, termination of proceedings on the arrest

remains valid until the entry into force of

the relevant judicial act. After the entry of the judicial

th act into legal force, the arbitration court at the request

person participating in the case, makes a decision on the

no measures to secure the claim or indicates it in the court

ny acts on the refusal to satisfy the claim, on the abandonment

claim without consideration, on termination of proceedings on the case

(Parts 4 and 5 of Article 96 of the Arbitration Procedure Code of the Russian Federation). The same meaning is fixed

in part 3 of Art. 144 Code of Civil Procedure of the Russian Federation.

If, when executing the ruling, the arbitration

court to secure a claim by seizing

money or other property belonging to

the defendant, the defendant provided counter security

by depositing funds into the court's deposit account

in the amount of the claims of the plaintiff or the provision of banks-

guaranty, guarantee or other financial guarantee

staking for the same amount, he has the right to apply to arbitration

ny court hearing the case, with a motion to set aside

provisional measures (part 3 of article 96 of the Arbitration Procedure Code of the Russian Federation).

Arrest imposed on property under criminal law

case, is canceled on the basis of a decision determined

the decision of the person or body in the production of which is

a criminal case, when in the application of this measure there is no

necessity (Part 9, Article 115 of the Criminal Procedure Code of the Russian Federation)1.

1 This part is recognized as inconsistent with the Constitution of the Russian Federation to the extent that it does not provide effective means protection of the legitimate interests of the owner of the seized property in cases of suspension of the preliminary investigation in a criminal case (see paragraph 3 of the operative part of the resolution of the Constitutional Court of the Russian Federation of January 31, 2011 No. 1-P).

It should also be noted that restrictions on the disposal of accounts can be removed by appealing against decisions on their introduction in the prescribed manner.

4. Scope of application of restrictions on the disposal of accounts. Suspension of operations on accounts applies only to accounts of legal entities and individual entrepreneurs opened on the basis of a bank account agreement (clause 2, article 11 of the Tax Code of the Russian Federation).

The seizure applies both to funds in bank accounts and to funds in deposits, i.e. on deposit accounts (deposit accounts). These accounts may belong to any individuals and legal entities (see Part 3, Article 69 of the Federal Law “On Enforcement Proceedings”, Part 7, Article 115 of the Code of Criminal Procedure of the Russian Federation).

In addition, it should be noted that in this case it was about the application of measures to accounts operating in the general mode.

For example, in relation to the bankruptcy procedure, there are already special measures, limiting orders

management of the debtor’s property, and the rules for the performance of his obligations, which are provided for by the Federal Law “On Insolvency (Bankruptcy)”.

When this procedure is opened, arrest as an interim measure and other restrictions on the disposal of the debtor’s property are removed (see paragraph 1 of article 63, paragraph 1 of article 81, paragraph 1 of article 94, paragraph 1 of article 126 of the Federal Law “ On Insolvency (Bankruptcy)”, subparagraph 6, paragraph 1, Article 50.19 of the Law on Insolvency (Bankruptcy) of Credit Institutions).

5. Responsibility of credit organizations for failure to perform

making decisions on the application of restrictions by order

accounts. Direct administrative liability for cases of non-execution of decisions on the application of restrictions on the disposal of accounts is established only in relation to decisions of tax authorities on the suspension of operations on the accounts of a taxpayer, payer of fees or tax agent (Article 134 of the Tax Code of the Russian Federation, Article 15.9 of the Code of Administrative Offenses of the Russian Federation).

At the same time, since these articles have different subjects of responsibility (according to Article 134 of the Tax Code of the Russian Federation - the credit institutions themselves

lowering, according to Art. 15.9 of the Code of Administrative Offenses of the Russian Federation - their officials), they can be applied simultaneously1.

In other cases, the Bank of Russia may apply to the credit institution the enforcement measures provided for in Art. 74 of the Law on the Central Bank of the Russian Federation).

In addition, for the performance by employees of a credit institution of banking transactions with funds (deposits), which are seized, they can be held criminally liable under Art. 312 of the Criminal Code of the Russian Federation.

Current civil law

Contractual restrictions

client rights

by order

funds on the account

Legislation expressly provides for the possibility of restricting the contract of operations performed on the client's bank account.

According to Art. 848 of the Civil Code of the Russian Federation, the bank is obliged to perform operations for the client that are provided for for accounts of this type by law, banking rules established in accordance with it and business practices applied in banking practice, unless otherwise provided by the bank account agreement.

On the basis of this provision, the bank may include in the agreement a list of operations that the client is not entitled to perform with this type of account, in addition to those operations, the impossibility of which is due to the prohibitions contained in regulatory enactments (for example, without identifying the client), or by the type of account being opened (for example, by transaction currency). At the same time, a systematic interpretation allows us to conclude that the contract can only narrow the list of operations and only those operations that are carried out on behalf of the client. It is impossible to expand the list of operations, since this will violate the regime of the corresponding type of account or the rights of collectors. For example, it is impossible to provide for the possibility of conducting operations in foreign currency on ruble accounts in an agreement, it is impossible to prohibit coercion in an agreement

1 Clause 2 of the Decree of the Plenum of the Supreme Arbitration Court of the Russian Federation dated January 27, 2003 No. 2 “On Certain Issues Related to the Enactment of the Code of Administrative Offenses of the Russian Federation”.

diligent debiting of funds from the account at the request of claimants on the basis of executive documents or in cases provided for by law, etc.

Under banking rules in this case, acts of the Bank of Russia are understood, since at present the types of bank accounts and their legal regime are established by the Bank of Russia as the body that determines the rules for performing banking operations, which include the opening of bank accounts (see paragraph 5 of Art. 4, article 57 of the Law on the Central Bank of the Russian Federation, paragraph 3, part 1, article 5 of the Law on Banks and Banking Activities).

In addition, in accordance with paragraph 3 of Art. 845 of the Civil Code of the Russian Federation, the bank is not entitled to determine and control the directions of use of the client's funds and establish other restrictions not provided for by law or the bank account agreement on its right to dispose of the funds at its own discretion.

Based on this provision, a bank account agreement may provide for restrictions on the rights of a bank client, i.e. his additional obligations, the observance of which is necessary for the bank to complete the operation on the account.

Banks quite widely use these provisions in practice. In particular, they use them:

To bring into a single list of all obligations (limitations of rights) of their clients established by various laws;

Securing in the contract those transactions that are not allowed on accounts of a certain type in accordance with acts of the Bank of Russia;

Fixing the client's obligation to comply with the rules for processing settlement documents and the bank's right to refuse him to conduct transactions in case of non-compliance with this obligation;

Ensuring the right of the bank to refuse to conduct an operation if the client violates the purpose of spending funds received as a targeted loan;

Suspension of transactions in case of suspicion of unauthorized access to the account

when using remote methods of account management or in case of suspicion of forgery of settlement documents;

Establishing limits on transactions using bank cards etc.

As can be seen from this list, the inclusion of such

conditions is due either to the fulfillment of the requirements of laws and acts of the Bank of Russia, or the need for banks to control the fulfillment of certain requirements by customers, or the need to protect the interests of customers (in particular, to prevent unauthorized debiting of funds from their accounts) .

It should be borne in mind that in a bank account agreement it is possible to establish individual (for a specific client) obligations (restrictions), since this type of agreement does not apply to public agreements. This conclusion is due to the following:

1) the legal regulation of civil law relations is based on a generally permissible type of legal regulation, which is based on the principle “everything is allowed, except for what is expressly prohibited”. With regard to bank account agreements, it is not explicitly stated that they are public contracts, such as retail purchase and sale agreements (clause 2, article 492 of the Civil Code of the Russian Federation), rental agreements (clause 3 of article 626 of the Civil Code of the Russian Federation), contracts bank deposits with individuals (clause 2, article 834 of the Civil Code of the Russian Federation), etc. Thus, there are no formal grounds for asserting that the rules for concluding public agreements are mandatory for bank account agreements;

2) bank account agreements do not have all the features of public agreements. In paragraph 2 of Art. 846 of the Civil Code of the Russian Federation provides for the possibility of a bank refusing to conclude a bank account agreement with a client, not only in cases provided for by law or other legal acts, but also if the bank is unable to accept a client for banking services.

interpretation (systemic interpretation allows us to state that in this case the impossibility of opening an account is due to the impossibility of making settlement transactions on it in a certain order, for example, using remote services, direct interbank relations, etc.).

Modern trends in judicial and arbitration practice do not fundamentally change the approaches outlined above. These trends include:

1) judicial and arbitration practice recognizes agreements concluded exclusively on the terms of the bank as accession agreements1. However, such recognition means an opportunity for the client to change the conditions that are burdensome for him or to terminate the contract (clause 2, article 428 of the Civil Code of the Russian Federation). In the absence of restrictions on the number and types of bank accounts opened by clients, as well as restrictions on cash settlements for individuals, the conditions for limiting debit transactions on a specific account should not be recognized as onerous;

2) recognition as inadmissible imposing on consumers the service of opening a bank account when performing other operations, since such imposition does not meet the requirements of paragraph 2 of Art. 16 of the Law of the Russian Federation “On Protection of Consumer Rights”, according to which it is prohibited to condition the purchase of certain goods (works, services) on the obligatory purchase of other goods (works, services). In the context of this Law, opening accounts, attracting deposits, issuing loans fall under the concept of services. In addition, individuals who are not entrepreneurs (consumers) pay in cash and non-cash without restrictions (clause 1 of article 861

1 In particular, the trend is expressed in clause 2 of the Information Letter of the Supreme Arbitration Court of the Russian Federation dated September 13, 2011 No. 147 “Review of judicial practice in resolving disputes related to the application of the provisions of the Civil Code of the Russian Federation on a loan agreement”.

Judicial and arbitration practice has developed the following criterion for determining cases when opening an account cannot be recognized as an imposed service: a bank account must be opened free of charge1.

Legal grounds debiting funds from an account

Write-off of funds from the account is carried out by a credit institution on the basis of the client's order (clause 1 of article 854 of the Civil Code

RF). This order can be expressed either in the form of a direct instruction to the credit institution to transfer (issuance) of funds, or in the form of consent to payment upon a claim submitted by the recoverer.

Write-off of funds from the account without the client's order is considered as an exception. Based on paragraph 2 of Art. 854

This is allowed by the Civil Code of the Russian Federation in the following cases:

1) by a court decision (i.e. on the basis of a writ of execution issued by a court or a court order);

2) in cases established by law (i.e. either on the basis of other executive documents, or on the basis of the provisions of the law).

The general list of executive documents and the terms for their presentation for execution are established in Art. 12 and 21 of the Federal Law “On Enforcement Proceedings”. In this case, it should be taken into account that, within the meaning of clause 5, part 1, art. 12 of the Federal Law “On Enforcement Proceedings”, acts of the bodies exercising control functions on the recovery of funds at the time of presentation of the relevant claims to a credit institution are not executive documents. They become such only after the credit institution notes that they are fully or partially unfulfilled.

1 See: p. 9 of the Information letter of the Supreme Arbitration Court of the Russian Federation dated September 13, 2011 No. 146

“Review of judicial practice on some issues related to the application

change to banks of administrative responsibility for violations

legislation on the protection of consumer rights when concluding

loan agreements.

due to the lack of funds in the accounts of the debtor.

It must also be noted that in the present At the same time, cases when it is possible to recover funds from an account without the consent of the payer (i.e., in an indisputable manner) should be established only by federal laws (clause 2, article 3, clause 2, article 854 of the Civil Code of the Russian Federation). However, on the basis of Art. 4

Federal Law No. 15-FZ dated January 26, 1996 “On the Enactment of Part Two of the Civil Code of the Russian Federation” on these issues, the regulatory acts of the President of the Russian Federation, the Government of the Russian Federation and the Government of the USSR, issued before the entry into force of Part Two of the Civil Code of the Russian Federation, continue to be valid provided that they do not contradict Russian legislation. Resolutions of the Supreme Council of the RF1 are also subject to this norm;

3) in cases stipulated by the agreement between the bank and the client.

However, this basis is not currently applicable.

is subject to, since the Federal Law “On the National Payment System” instead of direct debiting of funds introduced debiting on a pre-given acceptance (clause 3, article 6).

When applying paragraph 2 of Art. 854 of the Civil Code of the Russian Federation, it must be taken into account that it defines a wider list of grounds for debiting funds from accounts by banks without the order of customers than Part 3 of Art. 27 of the Law on Banks and Banking Activities, according to which the collection of funds and other valuables of individuals and legal entities that are on accounts and deposits or stored in a credit institution can only be levied on the basis of executive documents in accordance with the legislation of the Russian Federation.

These articles do not correlate as general and special, since they have different scopes. Article 854 of the Civil Code of the Russian Federation defines a list of cases when it is possible to write off funds from bank accounts without the consent of their authorities.

1 See: letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated

01.10.1996 No. 8 “On some issues of debiting funds,

on the account without the client's order.

businessmen, and art. 27 of the Law on Banks and Banking Activities applies not only to cash, but also to other valuables of clients with whom banks work ( For example, precious metals, securities). The scope of these articles overlaps only in the part related to the debiting of funds from bank accounts.

Codified acts, as already noted, cannot have unconditional priority over other federal laws.

Based on this, the specified conflict in terms of debiting funds from bank accounts should be resolved in favor of the provisions of the Civil Code of the Russian Federation as an act adopted later. In terms of foreclosure on other valuables stored in banks, Art. 27 of the Law on banks and banking activity.

In terms of tax collection at the expense of electronic money in relation to Part 3 of Art. 27 of the Law on Banks and Banking Activity, Art. 46

Although the bank has been granted the right to use the funds available on the account, the client freely (freely) disposes of them (clause 2 of article 845 of the Civil Code of the Russian Federation), which is guaranteed, in particular, by the following regulatory provisions:

- - the bank cannot determine and control the directions of use of the client's funds;

- - restrictions on the right to dispose of funds at the discretion of the client can only be established by law or an agreement (clause 3 of article 845 of the Civil Code of the Russian Federation). It is not a limitation of the right to dispose of the situation in which the write-off is made at the request of third parties, but on the basis of the client's order.

Certification of the right to dispose of the funds on the account.

The circle of persons who, on behalf of the client, carry out orders to make debit transactions (on the transfer and issuance of funds from the account), is determined according to the general rules on how to exercise the legal capacity of subjects of civil law (for an organization - through authorized bodies, through participants in cases established by law, and through representatives; for a citizen - through his own actions or through the use of the institution of representation).

In the banking sector, a distinction is made between the right of the first signature and the right of the second signature on payment documents. The right of first signature belongs to:

- 1) in relation to clients - individuals (including individual entrepreneurs) - the client or individuals to whom the client has issued a power of attorney;

- 2) for clients - legal entities - the head of the client (sole executive body), as well as other persons authorized by the client's administrative act or power of attorney; among other things, in cases established by the legislation of the Russian Federation, the right of first signature may be transferred to the manager or managing organization.

The right of a second signature (in relation to clients - legal entities), according to general rule, belongs to the chief accountant of the client and (or) persons authorized to maintain accounting records on the basis of the client's administrative act. If the head of the client maintains accounting records personally, then there are no persons with the right of a second signature.

It should be borne in mind that several employees of the organization may simultaneously have the right to first or second signature (their number is not limited), however, granting one individual the right to first and second signature at the same time is not allowed (clauses 7.5-7.10 of Instruction No. 28-I).

The rights of persons managing the funds on the account are subject to certification by submitting to the bank the documents provided for by law, banking rules and the agreement (clause 1 of article 847 of the Civil Code of the Russian Federation). Such documents, in particular, are protocols (orders, instructions) on the election (appointment) of the sole executive body, powers of attorney, etc.

In most cases, a credit institution is required to submit a card with samples of signatures and a seal imprint, in the corresponding field of which the handwritten signatures of persons with the right of the first (second) signature are affixed. The authenticity of signatures can be notarized; in addition, the card can be issued without notarization in the presence of an authorized official of the credit institution (clauses 7.12, 7.13 of Instruction No. 28-I). No other means of certifying (certifying) the authenticity of the signatures of persons with the right of the first or second signature, as well as the possibility of presenting an uncertified card, are provided.

In practice, the use of documents (mainly electronic means of payment) without handwritten signatures is becoming more common, but using special means in them confirming that the order was given by an authorized person: analogues of a handwritten signature, codes, passwords, etc. The legitimacy of such confirmation powers depends on whether the agreement allows this possibility (clause 3 of article 847 of the Civil Code of the Russian Federation).

An analogue of a handwritten signature is a personal identifier of a credit institution or its client, which is a control parameter for the correctness of compiling all the required details of a payment document and the invariance of their content. In this regard, payment documents signed by an analogue of a handwritten signature are recognized as having equal legal force with other forms of instructions of account holders signed by them with their own hand. The procedure for accepting for execution instructions of account holders, including those drawn up on electronic media, signed by an analogue of a handwritten signature, is currently determined by the Temporary Regulations of the Central Bank of February 10, 1998 No. 17-P.

A special kind of analogue of a handwritten signature is an electronic digital signature (hereinafter - EDS), which, of course, is used only in electronic documents, i.e. documents in which information is presented in electronic digital form. EDS is an attribute of an electronic document designed to protect this document from forgery, obtained as a result of cryptographic transformation of information using the EDS private key and allowing you to identify the owner of the signature key certificate, as well as to establish the absence of information distortion in electronic document. In order for an EDS to be recognized as equivalent to a handwritten signature, a number of conditions must be met: firstly, the signature key certificate has not lost its validity (valid) at the time of verification or at the time of signing an electronic document if there is evidence that determines the moment of signing; secondly, the authenticity of the EDS on the electronic document is confirmed; thirdly, the EDS is used in accordance with the information specified in the signature key certificate (Article 4 of the Federal Law of January 10, 2002 No. 1-FZ "On Electronic Digital Signature").